I used to think you needed to win the lottery or invent the next Facebook to get rich. Turns out, slow-and-steady habits can be far more powerful. Picture this: One New Year’s Eve, I scribbled down a resolution to finally get my finances in check—not exactly thrilling, right? But little did I know, boring could be the secret weapon for building wealth. Instead of chasing crypto crazes or trying to pick the next Tesla, what if you just set your investments to autopilot and (almost) forgot about them? Interesting things happen when you stop fiddling and let time do the heavy lifting.

2. Boring is Beautiful: The Magic Behind Automatic Investing

Every year, as the calendar flips to January, you might find yourself swept up in the wave of optimism that comes with New Year’s resolutions. According to recent findings, 53% of people are planning to make resolutions about money, finance, and investing this year (0.00-0.07). Maybe you’re one of them, determined that this will finally be the year you get your finances in order. But here’s the catch—most of us don’t follow through. Why? The answer might surprise you.

Let’s talk about the real cost of financial ignorance. It’s not just about the dollars you spend on lattes or the splurges you regret. The most expensive mistake you can make isn’t what you buy—it’s what you don’t know. As one expert put it,

The most expensive thing that all of us are paying for is the information that we don’t know.

This isn’t just a catchy phrase. Research shows that a lack of basic financial knowledge is more costly than bad spending habits alone. Missing out on years of slow, steady gains can set you back far more than any single shopping spree.

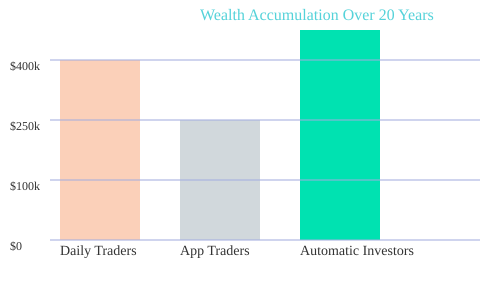

Why is this so common? Pop culture loves to glamorize risky tactics. You’ve seen the headlines: lottery winners, overnight crypto millionaires, or the friend who “struck gold” day-trading. It’s easy to believe that financial freedom is just one bold move away. But here’s the truth—those stories are the exception, not the rule. What’s rarely shown is how slow, steady methods quietly outperform chaos. The real magic happens when you automate your investing, stick to a plan, and let time do the heavy lifting.

Let’s break down the numbers and a personal lesson:

| Data Point | Details |

|---|---|

| Percentage making money/investing resolutions | 53% |

| Personal anecdote: Day-trading loss | $500 lost in a week |

I’ll be honest—I’ve been there. As a broke 20-something, I once lost $500 in a single week trying to day-trade. That was my worst financial hangover. It wasn’t just the money; it was the realization that I’d paid dearly for what I didn’t know. That week taught me more about personal finance tips and the importance of a healthy money mindset than any flashy headline ever could.

This is where the magic of automatic investing comes in. You don’t need to be rich, or wait until you’re over 40, to start building wealth. That’s one of the biggest investing myths out there. The reality? Anyone can set up automatic contributions to a retirement account or index fund. You don’t have to chase the next big thing or time the market perfectly. In fact, research indicates that steady, informed actions—like automatic investing—outperform risky attempts at quick wealth, time and time again.

But why do so many people fall into the trap of risky behavior? It’s a behavioral trap: we emulate bold headlines but miss quietly growing strategies. The stories that get shared are the ones with drama, not the ones where someone simply put $100 a month into an index fund for 20 years. Yet, those are the stories that build real, lasting wealth. The cost of financial ignorance isn’t just measured in dollars—it’s measured in years and lost gains. Every year you delay learning the basics or setting up automatic investing is a year you can’t get back.

If you’re serious about financial freedom strategies, it’s time to embrace the “boring” path. Automatic investing isn’t flashy, but it works. The magic lies in consistency, not chaos. The sooner you start, the more you’ll benefit from the quiet power of compounding—no lottery ticket required.

2. Boring is Beautiful: The Magic Behind Automatic Investing

If you think investing should feel like a high-stakes game in Vegas, it’s time to rethink your strategy. The real magic happens when you let automation do the heavy lifting. As mentioned around 0:34-0:44 in the transcript, mastering a few basic principles can put you in the top 5% of investors—without the stress or constant worry about your money. Let’s break down why automatic investing, target date funds, and habit investing are the unsung heroes of building wealth.

Why Automatic Investing Wins Every Time

Automatic investing is the simplest and most effective path for most people. Instead of trying to time the market or chase the latest trends, you set up regular contributions to your investment account. This approach not only builds a strong habit investing routine but also helps you avoid costly mistakes caused by emotional decisions. Research shows that automation leads to consistent investing and minimizes those “oops” moments that can derail your financial goals.

Target Date Funds: Set It and Forget It

Ever wish you could just pick one fund and let it do all the work? That’s exactly what target date funds offer. These diversified funds, available from low-cost brokers like Vanguard, Fidelity, and Schwab, are structured around your expected retirement year (think “Vanguard 2065”). They automatically adjust their risk level as you age, shifting from aggressive growth to more conservative investments over time. This means you don’t have to constantly rebalance or second-guess your choices—your portfolio evolves with you.

Let Your Turkey Cook: The Danger of Daily Portfolio-Checking

It’s tempting to check your investments every day, especially with flashy apps making it so easy. But here’s the truth: daily portfolio-checking can sabotage your results. Imagine opening the oven every five minutes to check on your Thanksgiving turkey—it just won’t cook right. The same goes for your investments. Constant tinkering often leads to emotional decisions and unnecessary trades, which can eat away at your returns. As the transcript suggests (0:39-0:44), sticking to a basic, proven plan is what separates successful investors from the rest.

Set-and-Forget: Why “Watching Paint Dry” Investing Works

There’s a reason why so many financial experts say, “Investors treat investing like watching paint dry—that’s how sexy it is, trust me.” The reality is, the most effective investing strategies are often the least exciting. By automating your contributions and letting your diversified funds do their job, you’re more likely to build wealth over time than if you’re constantly reacting to market noise. Studies indicate that this “set-and-forget” approach outperforms the hands-on, adrenaline-fueled style that many new investors fall for.

Personal Twist: Ditching the Flashy Apps

On a personal note, I made the switch to a finance-free phone. No more notifications, no more temptation to check my portfolio every hour. The result? Less stress, more time, and—most importantly—better investment results. Investing apps can be great for getting started, but they often encourage frequent trading, which is the opposite of what builds long-term wealth. Automation and inertia are your friends here.

Why 3-6 Month Check-Ins Are Enough

Instead of obsessing over your portfolio daily, try checking in every 3-6 months. This interval is recommended by many experts and aligns with the data: it’s just enough to make sure everything’s on track, but not so often that you’re tempted to make unnecessary changes. Remember, the goal is to let your investments grow quietly in the background while you focus on living your life.

Investors treat investing like watching paint dry—that’s how sexy it is, trust me.

Investing can be as dull as watching paint dry…and that’s exactly the point! Automation keeps you outsmarting emotional up-and-downs and builds riches most hype-chasers miss.

3. Anatomy of a Great Fund: What Actually Goes In, and Why It Works

When you hear the word “fund,” what does it really mean? At its core, a fund is simply a basket of investments—usually stocks, sometimes bonds, and often a mix of both. Imagine you want to own a piece of big names like Microsoft, Google, Nvidia, or Spotify. Instead of buying each stock individually (and trying to guess which will soar or flop), you buy a fund that holds hundreds of these companies for you. This is the magic of fund diversification—and it’s why boring investing often beats the hype (see transcript 4:05-4:17).

Let’s break it down even further. When you invest in a fund, you’re not just putting your money into one company. You’re spreading it across many, which means if one company struggles, your entire investment isn’t at risk. Research shows that diversified funds lower risk and remove the guesswork for beginners and busy investors. You don’t need to be a stock market expert or spend hours researching. The fund does the heavy lifting for you.

How Funds Work: The Pie Chart Analogy

Think of a fund as a pie chart. Each slice represents a different company or bond. When you invest, you’re buying a piece of the whole pie, not just one slice. As one investor put it:

All you do is put money into it…the fund like a pie chart is automatically diversified.

(transcript 3:42-3:47)

This automatic diversification is the core benefit. You don’t have to pick and choose stocks, worry about timing the market, or constantly rebalance your portfolio. The fund is designed to do all of that in the background.

Low-Cost Brokerages: Your Gateway to Investing

In the past, investing in funds could be expensive and complicated. Today, low-cost brokerage platforms like Vanguard, Fidelity, Schwab, and Hargreaves Lansdown (in the UK) have made it easy to get started. These investment platforms offer user-friendly interfaces and, in many cases, no minimum investment amounts (transcript 4:54-5:02). For example, you can begin with as little as £100 or $100. There’s no need to wait until you’ve saved thousands.

- Vanguard, Fidelity, Schwab: Global reach, trusted brands, low fees

- Hargreaves Lansdown (UK): No minimums for funds, free to invest in funds, but charges £11-12 per individual stock trade (transcript 7:09-7:13)

Major brokerages are designed to be accessible. Research indicates that these platforms make global access easy, even for first-time investors. You don’t need a financial advisor or a million-dollar portfolio to get started.

Automated and Boring: Why That’s a Good Thing

One of the biggest lessons from seasoned investors is that investing should be boring. You set up an automatic transfer into your fund every month and then… you leave it alone (transcript 3:58-4:00). No daily checking. No chasing hot stocks. No trying to “beat the market.”

In fact, many experts recommend checking your investments only every three to six months (transcript 6:11-6:17). It’s like putting a turkey in the oven for Thanksgiving: once it’s in, don’t keep opening the door. Let it cook—sometimes for decades. The less you fiddle, the better your results tend to be.

Why Funds Beat Stock Picking

Trying to pick individual stocks is not only stressful, but research shows even professionals struggle to consistently outperform the market. With a fund, you get exposure to hundreds of companies at once. If one company falters, the others help cushion the blow. This is the real power of fund diversification and why index fund returns are so compelling over time.

Chart: Typical Fund Starting Amounts and Providers

As you can see, most major providers let you start investing with just £100 or $100. The barriers are lower than ever, and fees matter more than most realize. By choosing a low-cost fund on a reputable platform, you’re setting yourself up for steady, reliable growth—without the stress of chasing the next big thing.

4. The Automation Chain: Master Your Money Flow Without Thinking

Imagine if your finances could run themselves—no more manual transfers, no more missed bills, no more second-guessing every purchase. That’s the power of a well-designed financial automation system. If you’re aiming to build wealth-building habits that stick, the secret isn’t in chasing the latest investment trend. It’s in setting up a conscious spending plan that works in the background, quietly moving your money exactly where it needs to go (10.18-10.22).

How the Automation Chain Works

Let’s break down the ideal flow:

- Salary in: Your paycheck lands in your checking account.

- Automated transfers: From there, money is automatically routed to savings, investments, and bills—no manual effort required (10.25-10.31).

- Guilt-free spending: Whatever remains in checking is yours to spend, worry-free, on the things you love (10.59-11.04).

As one expert puts it,

I have sub-savings accounts for vacation, car down payment, all that stuff…money is transferred to your investment account…credit card bill is automatically paid off every single month.

(10.42-10.55)

Sub-Savings Accounts: Goals on Autopilot

Automation isn’t just for investing. You can (and should) set up sub-savings accounts for specific goals—think vacations, a new car, or even holiday gifts. Each month, a set amount is whisked away from your checking account and deposited into these buckets. This simple step prevents emotional spending and keeps you on track, even when life gets busy (10.42-10.48).

Research shows that separating accounts for different goals helps avoid financial backsliding and emotional upheaval. When you see your vacation fund growing, you’re less likely to dip into it for everyday expenses. This is a cornerstone of a conscious spending plan—you’re not just saving, you’re saving with intention.

Automated Investing: Set It and Forget It

Once your savings are handled, the next step in the chain is automated savings for investing. Experts recommend directing 5-10% of your take-home pay into your investment account each month. The beauty? You don’t have to think about it. The money moves automatically, and you can let it “cook” over time, compounding quietly in the background (10.51-10.59).

Studies indicate that structuring your financial flow in this way ensures you hit all your goals without constant attention. Automatic transfers also prevent emotional or impulsive mistakes—like pulling money out of investments for a spontaneous purchase.

Automatic Bill Pay: Protect Your Credit, Free Your Mind

Don’t overlook the power of automatic bill pay. By setting up your credit card and recurring bills to be paid off in full each month, you protect your credit score and avoid late fees. More importantly, you free up mental space—no more worrying about missing a payment or racking up interest (10.55-10.59).

Real-Life Pitfall: Treating Investments Like a Checking Account

It’s tempting to dip into your investment account for big expenses or emergencies. But treating your investments like a checking account is a recipe for missed growth. A friend once made this mistake, pulling money out whenever something came up. The result? She missed out on years of compounding returns. With a solid automation chain, you can avoid this pitfall entirely.

Automate Once, Forget for Years

Here’s the real magic: set up your automation chain once, and you can forget about it for years. Your money will keep flowing to the right places, your goals will be funded, and your investments will grow—all without you lifting a finger. It’s like brushing your teeth, but even easier, since it’s truly effortless.

That’s the heart of financial automation: a system that quietly builds your wealth, keeps your spending intentional, and lets you enjoy life without financial stress.

5. The Power of Compounding: How Time Turns Small Steps Into Quiet Fortunes

Let’s get real about long-term investing. If you’ve ever felt overwhelmed by the endless hype around “hot stocks” or the latest crypto craze, you’re not alone. But here’s the quiet truth: boring, steady investing—especially when you start early—can quietly build wealth in ways that feel almost magical. The secret? Compound interest.

What Do Stock Market Returns Really Look Like?

First, let’s look at the actual investment returns data. According to research and historical data, the average return of the US stock market is about 10-11% per year before inflation, and about 7-8% after accounting for inflation (see transcript 11.51-12.09). That might sound abstract, but these numbers are the backbone of wealth creation for patient investors.

| Data Point | Value |

|---|---|

| Stock Market Returns (US, Nominal) | 10-11% annually |

| Stock Market Returns (US, After Inflation) | 7-8% annually |

| Starting Balance Example | $5,000 at age 16 |

| Annual Investment | $5,000 per year (approx. $400/month) |

Plug In Your Numbers—Prepare to Be Shocked

Maybe you’re thinking, “7%? That doesn’t sound like much.” But here’s where the magic of compounding comes in. If you go right now and Google ‘investment calculator,’ plug in your age, and enter an amount—say, $200 or $300 a month at a 7% return—you just watch how that money grows. As one interviewee put it:

If you go right now and Google investment calculator…you just watch how that money grows—you will be shocked.

Tools like the MoneyChimp compound interest calculator make this easy (transcript 12.16-12.45). You don’t need to be a math whiz—just enter your starting balance, your monthly or yearly contribution, and an estimated return. The results are often jaw-dropping.

How Early Steps Become Quiet Fortunes

Let’s walk through a scenario. Imagine you start at age 16 with $5,000—maybe from a summer job or a gift. You commit to adding $5,000 each year (about $400 a month). Using the average 7% return, your investment doesn’t just grow in a straight line. It compounds. That means you earn interest on your contributions and on the interest itself. Over decades, this snowballs into something much bigger than you might expect.

- Start early, even with small amounts.

- Stay consistent—monthly or yearly contributions matter more than you think.

- Let time do the heavy lifting. The longer your money stays invested, the more compounding works in your favor.

The Wild Card: Forget and Be Amazed

Here’s a fun twist: imagine you set up an automatic transfer of just $100 a month into an investment account and forget about it for 10 years. One day, you log in and see a balance that’s far larger than you remember contributing. That’s compounding at work—quiet, relentless, and surprisingly powerful.

Why Visualization Tools Matter

Research shows that compounding results in exponential—not linear—wealth growth for patient investors. It’s not always easy to grasp this just by looking at numbers. That’s why visualization tools and calculators are so valuable. They make the impact of time in the market real and tangible. When you see a chart or table showing your potential growth, it’s no longer just theory—it’s a plan you can believe in.

Compounding is magic in slow motion. Even small, regular contributions can transform into a fortune—the numbers are more impressive than most people expect at first glance. The lesson? Don’t underestimate the power of starting early and letting time work for you. In the world of long-term investing, patience and consistency quietly beat the hype every time.

6. Popular Myths vs. Real World Wealth: Why Overnight Success Stories Miss the Point

When you think about building wealth, what’s the first story that comes to mind? For most people, it’s the headline-grabbing tales: the tech founder who sells a company for millions, the lucky lottery winner, or the crypto investor who “made it big” overnight. These stories are everywhere, and it’s easy to see why they’re so appealing. But if you look closer, you’ll find that these overnight success stories are the exception, not the rule (11.32-11.39). The real path to wealth is much less glamorous—and a lot more reliable.

Let’s get real: headlines exaggerate the importance of lucky breaks. Whether it’s a sudden crypto boom or a friend-of-a-friend who “got in early” on a hot stock, these stories make it seem like wealth is just a gamble away. But research shows that for most people, long-term, fund-based investing beats short-term gambles every time (11.18-11.24).

Why the “Paint Drying” Approach Works

If you’ve ever heard someone compare investing to watching paint dry, you know it doesn’t sound exciting. But that’s exactly the point. The narrative we see about how—and why—people get rich is, frankly, wrong. As one expert put it:

The narrative we see about how—and why—people get rich is…wrong. Real research proves the slow lane wins.

What does the research actually say? Over more than 100 years, the data is clear: index funds, which simply track the overall market, have consistently outperformed frantic individual stock picks and trendy investments (11.47-11.57). In the U.S., index fund returns average around 10-11% annually. That’s not flashy, but it’s powerful—especially when you stick with it over time.

Investing Myths That Just Won’t Die

- Myth #1: You need a lucky break to get rich.

- Myth #2: Only market geniuses can build real wealth.

- Myth #3: The best way to invest is to chase what’s trending.

Here’s the truth: real wealth is almost always quietly built, outside of the headlines. Fund-based, automatic investing is accessible to nearly everyone and doesn’t require you to be a market genius. In fact, studies indicate that setting up simple, systematic contributions—like automatic monthly investments—beats emotional, knee-jerk decisions every time.

Real-World Lessons: The Cab Driver Test

Let’s take a quick tangent. If I had a dollar for every time my cab driver pitched me a “sure thing” investment, I’d be rich—ironically, not from investing, but from collecting those dollars. This is a classic example of how investing myths spread. Everyone wants to believe in the next big thing, but few realize that slow and steady investing wins the race.

Case Studies: Boring Wins (Every Time)

Consider the countless case studies where people simply set up automatic contributions to index funds and let time do the work. No drama, no hype—just consistent action. Over decades, these “boring” investors end up with far more wealth than those who chase trends or try to time the market. It’s not magic; it’s just math and patience.

Even Beyoncé Can’t Beat the System

Here’s a wild card for you: if Beyoncé’s investment strategy was just to buy whatever’s trending, even she’d eventually go broke! The lesson? No one, no matter how talented or famous, can outsmart the power of slow and steady investing habits.

Popular culture loves the myth of sudden wealth, but history and data show that boring, systematized investing works better. If you focus on building wealth through consistent, fund-based investing—rather than chasing the next big thing—you’re far more likely to reach your financial goals. In the end, it’s the “paint drying” approach that quietly builds real, lasting wealth.

7. Putting It All Together: Start Small, Stay Steady, and Ignore the Noise

Let’s be honest: anyone can build wealth, but not everyone will. Most people never even start. If you’re reading this, you’re already ahead of the curve—because you’re thinking about your future and how to make your money work for you. The truth is, you don’t need to be rich, lucky, or even particularly savvy to begin. What matters most is taking that first step, no matter how small or imperfect it feels.

Maybe you’re thinking, “I can’t afford to invest” or “It must be nice for people who have extra cash lying around.” But here’s a reality check, drawn straight from experience (see 8.28-8.37): if you look closely at your spending, chances are you can find at least 5% to save or invest each month. It’s not about deprivation, but about making your money align with your goals. That could mean cutting back on something small, or simply redirecting a bit of your monthly flow. You don’t have to overhaul your entire life overnight.

So, what’s the best way to start? Don’t wait for the perfect moment or the perfect plan. Pick one action—just one. Set up an automated savings transfer, choose a simple index or target date fund, or map out your monthly cash flow. The key is to do something today, even if it feels messy or incomplete. Research shows that small, steady steps—especially those that are automated—build wealth-building habits far more effectively than big, unsustainable efforts. In fact, behavioral economics tells us that most people overestimate how hard it is to start automated investments. The reality? It’s easier than you think.

Investing is even easier than brushing your teeth because you set it up automatically.

Think about that for a moment (see 8.42-8.46). Once you set up automated savings or investments, you don’t have to remember to do it every month. The money moves from your checking account to your investment account without you lifting a finger. Whether it’s $100, $500, or $1,000 a month (see 8.55-8.57), the process is the same. And here’s the magic: after a few months, you’ll log in and be surprised at how much you’ve accumulated—without even noticing (see 9.03-9.08). Add the power of compounding over years, and that’s how real wealth is built (see 9.12-9.17).

Your “rich life” doesn’t have to look like anyone else’s. Maybe it’s travel, more time with family, or guilt-free lattes. The beauty of habit investing and automated savings is that your system can support your dreams, whatever they are. You don’t need to wait for a windfall or until you “feel ready.” Start with whatever you can today, and let your system do the heavy lifting.

Imperfection is not just acceptable—it’s expected. It’s far better to start messy now than to wait for the perfect moment that never comes. Inertia is a powerful force, but so is momentum. Once you automate your savings or investments, you’re building a habit that will quietly, steadily, and reliably grow your wealth in the background. Studies indicate that automatic systems make real, meaningful wealth-building accessible to anyone, regardless of income or experience.

So, what are some practical next steps? Set up a target date fund if you want a simple, hands-off approach. Schedule an account review day once a quarter to check in on your progress. Most importantly, automate savings at a level that matches your lifestyle—no need for heroics, just consistency. These small changes, done consistently, will do more for your financial future than any flashy, high-risk move ever could.

There’s never a perfect moment to begin, but inertia is a powerful force. Pull the trigger, ignore the noise, and let your future self thank you. The journey to wealth isn’t about luck or timing—it’s about building steady, sustainable habits that work quietly in the background, day after day. Start small. Stay steady. Ignore the noise. That’s how you win at the wealth-building game.

TL;DR: Automating your investments, avoiding daily tinkering, and sticking with diversified funds can quietly build more wealth than obsessive trading or chasing trends. Real-world data and simple math prove this approach works—even if it doesn’t make for flashy headlines. Start small, stay patient, and focus on habits, not hype.

A big shoutout to The Diary Of A CEO for their enlightening content! Be sure to check it out here: https://youtu.be/jyCJeglqCe4?si=OOjkvjDGf_z2lGq1.