Imagine being a recent graduate with a marketing degree. You should be on your way to starting a thriving career, but instead, you’re juggling two retail jobs that barely allow you to afford the essentials. This is the reality for many members of Generation Z, who are navigating an economic landscape riddled with uncertainty and growing costs. In this post, we’ll peel back the layers of financial distress experienced by Gen Z and explore what it means for their future.

The Paradox of Education and Employment

In today’s world, you might find it surprising that many graduates are struggling to find suitable jobs despite their high levels of education. This situation creates a paradox that leaves many feeling disillusioned. How can someone with a degree still face unemployment or underemployment? The reality is that the job market has not kept pace with educational attainment, leading to a significant gap between what graduates expect and what they experience.

High Levels of Education but Struggling with Job Placements

Imagine spending years in school, accumulating knowledge and skills, only to find that the job you land is far below your qualifications. This is the reality for many young people today. Over 40% of Gen Z graduates feel underemployed. They hold degrees but often work in roles that do not require them. This disconnect creates frustration and anxiety.

-

Many graduates are overqualified for their roles.

-

Job placements have not kept pace with educational attainment.

-

Rising student loan debt compounds issues.

It’s ironic, isn’t it? You invest time and money into your education, only to end up in low-wage jobs. This situation raises questions about the value of a degree in today’s economy. Are degrees losing their worth? Or is the job market simply not adapting to the needs of the educated youth?

The Irony of Graduates Working in Low-Wage Jobs

Many graduates find themselves in positions that pay minimum wage or slightly above. For instance, a business marketing graduate might end up working in retail, earning between $10 and $25 per hour. This is a stark contrast to the expectations set during their years of study. You might wonder, how does one go from studying marketing strategies to folding clothes in a store?

As you consider this irony, it’s essential to recognize the broader implications. Graduates are not just facing financial challenges; they are also grappling with the emotional toll of underemployment. The pressure to succeed can be overwhelming. As one expert put it,

“A degree no longer guarantees a job, which puts immense pressure on young graduates.”

Statistics on Underemployment Among Educated Youth

The statistics surrounding underemployment are alarming. With over 40% of Gen Z graduates feeling underemployed, it’s clear that this is not an isolated issue. The average student loan debt for Gen Z is over $30,000. This financial burden can lead to significant stress and anxiety. You might be asking yourself, how can someone start their life with such a heavy weight on their shoulders?

Consider this: many graduates are forced to make tough choices. They may have to take jobs that do not align with their career goals just to make ends meet. This situation can lead to a cycle of dissatisfaction and financial instability. The irony is that while education is meant to empower, it can also lead to a sense of entrapment when job opportunities are scarce.

Understanding the Impact of Student Debt

The rising student loan debt is a critical factor in this paradox. With many graduates unable to find jobs that pay well, they struggle to repay their loans. This situation creates a vicious cycle. The more debt they accumulate, the more pressure they feel to take any job available, regardless of whether it aligns with their qualifications.

As you reflect on this, it’s essential to recognize that the job market is changing. Traditional paths may no longer be the best option for many. More graduates are considering vocational training or alternative education paths that promise better job prospects. This shift reflects a growing awareness of the need for practical skills in today’s economy.

Chart: The Reality of Gen Z Graduates

Here’s a visual representation of the challenges faced by Gen Z graduates:

This chart highlights the stark reality faced by many Gen Z graduates. The high percentage of underemployment and the burden of student loan debt paint a clear picture of the challenges ahead.

In conclusion, the paradox of education and employment is a pressing issue that affects many young people today. As you navigate this landscape, it’s crucial to stay informed and adaptable. The world is changing, and so must the paths we take toward our careers. Understanding these dynamics can empower you to make informed decisions about your future.

Housing: The Unattainable Dream

In today’s economy, inflated housing prices make renting and buying homes a significant hurdle for the younger generation. You might be wondering, why is owning a home such a distant dream for so many? The answer lies in the stark reality of escalating rent prices compared to wages.

Escalating Rent Prices vs. Wages

Let’s break this down. Over the past few years, rent prices have skyrocketed. In urban areas, they have increased by an astonishing 20% over just five years. Meanwhile, wages have not kept pace. This disparity creates a financial strain that many young adults feel acutely.

-

Imagine earning a paycheck that barely covers your rent.

-

How can you save for a home when your entire salary goes to housing costs?

It’s no surprise that 76% of Gen Z believes home ownership is unattainable. This statistic reflects a broader sentiment among young adults today. They feel trapped in a cycle of renting, with little hope of breaking free.

Statistics on Young Adults Living with Parents

As rent prices soar, many young adults are finding it increasingly difficult to afford their own place. In fact, a significant number of them are moving back in with their parents. This trend is not just a temporary solution; it’s becoming a long-term living arrangement for many.

-

Are you one of the many young adults living at home?

-

Do you feel the pressure of societal expectations to move out and be independent?

Living with parents can provide some financial relief, but it also comes with its own set of challenges. The desire for independence clashes with the harsh realities of the housing market. You might feel like you’re stuck between a rock and a hard place.

Impact of Housing Market Trends on Aspirations

The impact of these housing market trends on aspirations is profound. Many young adults are rethinking their goals. The dream of home ownership, once a rite of passage, now feels like an impossible dream. As John, a 24-year-old marketing graduate, puts it:

“Owning a home seems like an impossible dream for many of us.”

This sentiment resonates with many in your generation. The traditional milestones of adulthood—buying a home, starting a family—are being pushed further out of reach. Instead of focusing on these goals, many are forced to prioritize immediate needs like rent and groceries.

Understanding the Data

Let’s take a closer look at the numbers. The data paints a clear picture of the challenges faced by young adults today:

-

76% of Gen Z believes home ownership is unattainable.

-

Rent prices have increased by 20% in urban areas over five years.

These statistics highlight a troubling trend. As the cost of living rises, the gap between wages and housing costs widens. This is not just a personal issue; it’s a societal problem that needs addressing.

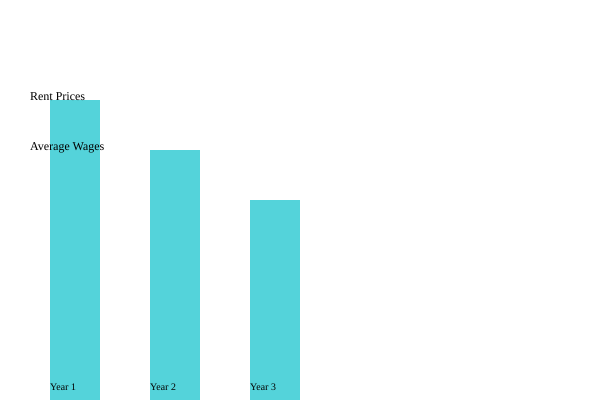

Visualizing the Challenge

To better understand this issue, let’s visualize the data. Below is a chart that compares rent prices to average wages over the years. This visual representation helps illustrate the growing divide between what young adults earn and what they need to pay for housing.

This chart clearly shows the disparity between rent prices and average wages over the years. The gap is widening, and it’s affecting your generation’s ability to achieve the dream of home ownership.

As you reflect on this information, consider how these trends impact your life and the lives of those around you. Are you feeling the pressure of rising costs? Do you see a way forward? The answers to these questions may shape your future in ways you never expected.

The Job Market: Opportunities and Obstacles

The job market today is a complex landscape, especially for Generation Z. You might be wondering, what makes it so different from previous generations? Well, let’s dive into the current dynamics that shape the employment situation for young people today.

Unemployment Rates Among Gen Z

First, let’s talk about unemployment. The global youth unemployment rate stands at a staggering 13%. This figure is alarming, especially when you compare it to previous generations. In the past, young adults often found jobs more easily after graduation. Today, many face a different reality.

For instance, you might know someone who graduated with a degree but is stuck in a low-paying retail job. It’s not uncommon. Many young adults are struggling to find stable employment. The pandemic has only exacerbated this issue. Reports indicate that around 47% of Gen Z members or their households have experienced job losses or pay cuts due to COVID-19. This has led to financial strain and increased mental health issues.

The Gig Economy: A Double-Edged Sword

Now, let’s shift our focus to the gig economy. It’s often described as both a blessing and a curse. Why? Because while it offers flexibility and opportunities, it also comes with instability. As one young worker put it,

“The gig economy is both a blessing and a curse for my generation – we find opportunities, but it’s unstable.”

Many Gen Z individuals are turning to freelance or gig jobs to make ends meet. This shift is significant. According to data, about 30% of Gen Z are thriving in the gig economy. They are finding ways to leverage technology and create their own opportunities. However, the lack of job security can be daunting. You might ask yourself, how can one build a stable future in such an unpredictable environment?

Emerging Sectors Where Gen Z Finds Footing

Despite these challenges, there are emerging sectors where Gen Z is finding their footing. Technology, digital marketing, and sustainability are just a few areas where young adults are making strides. These fields often offer more opportunities for innovation and creativity. They align with the values of many young people today, who prioritize meaningful work over traditional career paths.

Moreover, the rise of remote work has opened doors that were previously closed. You can work from anywhere, which is appealing to many. This flexibility allows for a better work-life balance, something that Gen Z highly values. But, it also raises questions about long-term job security and benefits.

Understanding the Current Job Market Dynamics

So, what does all this mean for you? Understanding the current job market dynamics is vital for grasping Gen Z’s employment situation and financial strategies. The landscape is shifting, and you need to be aware of the opportunities and obstacles that lie ahead.

|

Statistic |

Value |

|---|---|

|

Youth Unemployment Rate |

13% Globally |

|

Gen Z Thriving in Gig Economy |

30% |

As you can see from the table, the challenges are significant. Yet, the opportunities are also present. The gig economy, while unstable, offers a chance for many to carve out their own paths. It’s a balancing act, and you must navigate it wisely.

In conclusion, while the job market presents numerous obstacles for Gen Z, it also offers unique opportunities. The key is to stay informed and adaptable. Whether you’re considering a gig job or looking for a stable position in a traditional sector, understanding the current landscape will help you make informed decisions.

Mental Health Implications of Financial Stress

Financial stress is more than just a number in your bank account. It can deeply affect your mental health. When you think about it, how often do you feel anxious about money? You’re not alone. Many people, especially in Generation Z, are grappling with this issue. The connection between financial distress and mental health is critical. It’s a cycle that can be hard to break.

The Relationship Between Financial Distress and Mental Health

Financial troubles can lead to feelings of inadequacy and low self-esteem. Imagine working hard, getting a degree, and still struggling to make ends meet. It’s frustrating, right? Many Gen Z members are facing this reality. They often feel financially insecure despite their academic achievements. This insecurity can lead to anxiety, depression, and other mental health issues.

When you’re constantly worried about money, it’s tough to focus on anything else. This stress can manifest in various ways, from sleepless nights to difficulty concentrating at work. It’s essential to recognize that financial health and mental health are intertwined. As one expert puts it,

“Mental health is just as critical as financial health; they go hand in hand.”

Statistics on Gen Z’s Mental Health Issues

Let’s look at some eye-opening statistics. Did you know that 47% of Gen Z report poor mental health due to financial stress? That’s nearly half of this generation feeling overwhelmed by money issues. Furthermore, suicidal thoughts among Gen Z have increased by 25% in recent years. These numbers are alarming and highlight the urgent need for support and resources.

Here’s a table that summarizes these statistics:

|

Statistic |

Percentage |

|---|---|

|

Gen Z reporting poor mental health due to financial stress |

47% |

|

Increase in suicidal thoughts among Gen Z |

25% |

Resources Available for Mental Well-Being

So, what can you do if you find yourself in this situation? Thankfully, there are resources available to help you cope with financial stress and its mental health implications. Here are some options:

-

Counseling Services: Many colleges and universities offer free or low-cost counseling services. Speaking with a mental health professional can provide you with coping strategies.

-

Financial Literacy Programs: Understanding how to manage your finances can alleviate some stress. Look for workshops or online courses that teach budgeting, saving, and investing.

-

Support Groups: Sometimes, talking to others who are going through similar struggles can be comforting. Look for local or online support groups focused on financial stress and mental health.

-

Hotlines: If you’re feeling overwhelmed, don’t hesitate to reach out for help. There are hotlines available that can provide immediate support.

Increasing awareness around mental health resources is crucial. You might be surprised to learn that many people are unaware of the support available to them. It’s essential to spread the word and encourage others to seek help when needed.

Financial struggles contribute heavily to the mental health crisis currently impacting Generation Z. The statistics are stark, but they also serve as a call to action. It’s time to improve resources and support systems for those affected. Remember, you’re not alone in this fight. There are people and resources ready to help you navigate these challenging times.

Coping Strategies and Future Outlook

Generation Z stands at a unique crossroads. They face financial challenges that many previous generations have never encountered. How are they adapting? What innovative ideas are they bringing to the table? And why is community support so vital for their resilience? Let’s explore these questions together.

Adapting to Financial Challenges

First, let’s talk about adaptation. Gen Z is known for their resourcefulness. They’ve grown up during economic uncertainty, which has shaped their perspectives on money and work. Many are leveraging technology to navigate their financial challenges. For instance, did you know that 33% of Gen Z utilize budgeting apps? These tools help them track expenses and manage their finances more effectively.

But it’s not just about using apps. Gen Z is also finding creative ways to earn money. Side hustles are becoming the norm. Whether it’s freelancing, online tutoring, or even selling handmade crafts, they’re not afraid to hustle. This adaptability is crucial in a world where traditional job security is fading.

Innovative Ideas and Solutions

Innovation is another hallmark of Gen Z. They’re not just accepting the status quo; they’re challenging it. For example, many are turning to alternative education paths. With the rising costs of higher education, vocational training and online courses are gaining popularity. This shift reflects a desire for practical skills that lead to employment.

-

Vocational training: Many are opting for trades that offer good pay without the burden of student debt.

-

Online courses: Platforms like Coursera and Udemy allow them to learn at their own pace, often at a fraction of the cost of traditional education.

Moreover, Gen Z is embracing entrepreneurship. They’re starting businesses that align with their values, such as sustainability and social justice. This generation is not just looking for a paycheck; they want to make a difference. It’s a refreshing perspective that could reshape industries.

The Importance of Community Support

Now, let’s dive into the role of community. In tough times, having a support network is invaluable. Gen Z understands this. They often say,

“We learn best from each other in our community; that’s how we navigate these tough times.”

This sentiment highlights the importance of collaboration and shared experiences.

Community support can take many forms. From online forums to local meetups, Gen Z is finding ways to connect. These networks provide not just emotional support but also practical advice. When someone shares a budgeting tip or a job lead, it can make a world of difference.

Interestingly, 45% of Gen Z believe community support is vital for financial resilience. This statistic underscores the idea that they’re not in this alone. They recognize that pooling resources and knowledge can help everyone thrive.

Leveraging Technology for Financial Education

Technology plays a significant role in how Gen Z approaches financial education. They have access to a wealth of information at their fingertips. Online resources, webinars, and social media platforms are filled with tips and tricks for managing money. This generation is savvy; they know how to seek out information that can help them.

For example, many are turning to social media influencers who specialize in personal finance. These influencers break down complex financial concepts into digestible content. It’s a way for Gen Z to learn about investing, saving, and budgeting in a relatable manner.

Looking Ahead

As we look to the future, it’s clear that the ability to adapt and innovate will be crucial for Generation Z. They’re facing ongoing economic hurdles, but their resilience is inspiring. With their unique perspectives and collaborative spirit, they have the potential to redefine what success looks like.

In summary, Gen Z is not just surviving; they’re thriving in the face of adversity. By leveraging technology, embracing community support, and thinking outside the box, they are carving out their own paths. As they continue to navigate these challenges, one thing is certain: their journey will be one to watch.

Charting a New Path

As we wrap up our exploration of the challenges faced by Generation Z, it’s clear that the road ahead is filled with both obstacles and opportunities. This generation is navigating a complex landscape marked by economic uncertainty, rising costs, and shifting societal expectations. But amid these challenges, there lies a significant chance for change.

The Importance of Policy Changes

One of the most pressing needs is for policy changes that genuinely support Gen Z. Current policies often fail to address the unique struggles this generation faces. For instance, housing affordability has become a critical issue. With rents skyrocketing and home ownership feeling like a distant dream, it’s essential for lawmakers to prioritize initiatives that make housing accessible. This could involve increasing funding for affordable housing projects or implementing rent control measures.

Moreover, educational reforms are equally vital. As higher education costs continue to rise, many young people are burdened with debt. Policies that promote vocational training or community college pathways can provide more affordable and practical options. By shifting the focus from traditional four-year degrees to diverse educational opportunities, we can better equip Gen Z for the job market.

Encouraging Societal Recognition

But it’s not just about policy. We also need to foster societal recognition of these challenges. Many people may not fully understand the financial pressures that Gen Z faces. By raising awareness, we can create a more supportive environment. This involves open conversations about mental health, job satisfaction, and the realities of living in today’s economy. When society acknowledges these issues, it can lead to actionable change.

Consider this: how often do we hear about the struggles of young adults in our communities? By sharing stories and experiences, we can humanize these challenges and inspire empathy. This societal shift can encourage businesses and organizations to adapt their practices, making them more inclusive and supportive of young workers.

The Hope for a Better Economic Future

Despite the hurdles, there is hope for a better economic future. Generation Z is known for its resilience and adaptability. Many young people are already redefining what success looks like. They are embracing entrepreneurship, exploring side hustles, and seeking work environments that align with their values. This shift towards a more flexible work-life balance is a positive sign of change.

Moreover, as wages for Gen Z increase, albeit slowly, there’s potential for financial stability. The rise of remote work has opened new doors, allowing young adults to seek opportunities beyond their immediate geographical locations. This flexibility can lead to better job prospects and improved quality of life.

“Empowering the next generation is crucial for our society’s progress.”

This quote resonates deeply as we consider the future. By empowering Gen Z, we are investing in our collective future. Supporting their growth through effective policies and societal recognition can lead to a thriving economy. It’s about creating an environment where young people can flourish, innovate, and contribute meaningfully to society.

To ensure a thriving future for Generation Z, we must collectively acknowledge and address these financial struggles. This isn’t just a responsibility for policymakers; it’s a call to action for all of us. Whether you’re a business leader, educator, or community member, your role is vital. Together, we can foster a more supportive environment that allows Gen Z to thrive.

In conclusion, the path forward requires a concerted effort from all sectors of society. By prioritizing supportive measures for youth, recognizing the challenges they face, and fostering hope for the future, we can chart a new path for Generation Z. This generation is not just facing challenges; they are poised to reshape our world. Let’s empower them to do so.

TL;DR: Generation Z faces unprecedented financial challenges, from soaring housing prices to a strained job market, making it harder for this cohort to achieve financial stability and plan for the future.

Gen Z and Financial Challenges

❓ Why is Gen Z facing more financial struggles than previous generations?

Gen Z has entered adulthood during a time of rising inflation, student loan debt, economic uncertainty, and a highly competitive job market. Many are burdened with high living costs, limited savings, and delayed access to stable income and housing.

❓ How does student debt affect Gen Z’s financial future?

Student loans significantly impact Gen Z’s ability to save, invest, or even consider major life steps like buying a home. With higher education costs rising, many are forced to delay financial milestones due to long-term debt repayment.

❓ What role does the job market play in Gen Z’s struggles?

While Gen Z is one of the most educated generations, they often face unstable employment, underpaid entry-level jobs, or gig work without benefits. This lack of job security creates added stress and limits financial growth.

❓ Are Gen Z spending habits contributing to their financial challenges?

Partially. Gen Z tends to value experiences and tech, and many engage in online shopping and instant gratification spending. However, surveys also show they are highly aware of budgeting tools and are more likely to seek financial literacy resources than previous generations.

❓ How is inflation impacting Gen Z’s cost of living?

Rising prices for housing, transportation, food, and healthcare have made it harder for Gen Z to afford basic living expenses. Even full-time workers often find it difficult to keep up with the cost of living in major urban areas.

❓ What are some financial priorities for Gen Z today?

Many Gen Zers prioritize saving for emergencies, paying off debt, achieving work-life balance, and even starting side hustles. They value financial independence and seek flexible income opportunities more than traditional career paths.

❓ What steps can Gen Z take to improve their financial situation?

-

Build financial literacy early

-

Track spending and create a realistic budget

-

Avoid high-interest debt

-

Focus on long-term saving & investing

-

Explore side hustles or freelance opportunities

-

Use technology for smarter money management