A few weeks ago, I found myself staring at a half-empty grocery store shelf, wondering what invisible hand had made my favorite snack vanish overnight. Turns out, understanding the impact of tariffs isn’t reserved for economists or policy wonks; it shows up in your cart (and your bank account), too. In this post, let’s navigate the maze of tariffs, economic mind games, and old lessons in money—all in plain English, with a few unexpected twists. Think of it as your backstage pass to an economic drama where everyone, yes, even you, has a speaking part.

1. Tariffs: The Economic Wildcard No One Saw Coming

If you’ve been following the news lately, you’ve probably heard a lot about tariffs. But what’s really at stake? According to experts, “It has the potential to be the biggest economic story of our lives.” (0.02-0.05) That’s not an exaggeration. Tariffs aren’t just some abstract policy—they’re already causing people to lose money, and most of us don’t realize how close we are to seeing empty shelves at our favorite stores (0.05-0.10).

Why Tariffs Matter More Than You Think

Let’s break down the tariffs impact explained. Unlike past economic crises—think 9/11, the 2008 financial crash, or even COVID-19—tariffs are unique because they can be ended instantly. There’s literally a button on the president’s desk that says, “End it right now.” (0.10-0.11, 5.14-5.17) With one decision, the entire crisis could be over. Compare that to the slow, painful unwinding of other disasters, and you start to see why this is such a wild card.

Global Trade: A Delicate Machine Under Threat

Think of the global economy as a finely tuned machine. Usually, policymakers try to tweak it gently—turning a dial here, adjusting a lever there. But tariffs? That’s like smashing the machine with a baseball bat or a crowbar (6.02-6.08). The result? Unpredictable, often dramatic, global trade effects that ripple out in ways nobody can fully anticipate.

Just walk into your local Target, Walmart, or grocery store and check the labels. Products come from all over the world (6.13-6.23). When tariffs go up—sometimes overnight, from 10% to a staggering 145%—the cost of those goods can skyrocket. Retailers scramble. Shelves can empty fast. And you, the consumer, feel it in your wallet.

The Hidden Cost of Trade Barriers

Maybe you’ve tried to buy a new phone or laptop recently and noticed prices creeping up. That’s not just inflation—it’s the hidden cost of trade barriers. Tariffs can hit electronics especially hard, but groceries, clothes, and household goods aren’t immune. Research shows that supply chain disruptions can be both immediate and lingering. Even if the “end it now” button is pressed, trust and stability in the global system take time to recover (5.17-5.22).

When the Rules Change Overnight

Here’s what makes tariffs so dangerous: they can be raised or lowered swiftly, with little warning. Retailers like Target, Walmart, and Apple depend on predictable trade flows. When those are disrupted, everyone—from big corporations to local shop owners—has to adapt, often at a loss. Studies indicate that both retailers and consumers are exposed to sudden changes in global trade policy, making the entire system feel unstable.

“It has the potential to be the biggest economic story of our lives.”

“There’s a button on the president’s desk that says, ‘End it right now.’”

Tariffs in Action: The Numbers

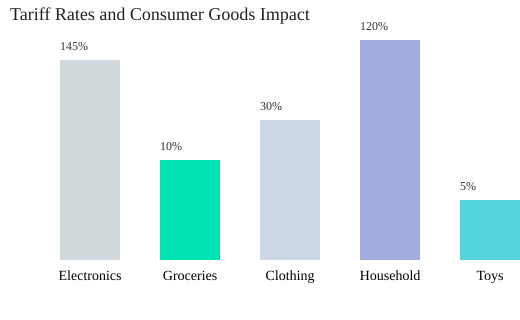

To put things in perspective, here’s a look at how different tariff rates can hit your everyday purchases:

As you can see, the impact of tariffs isn’t just a headline—it’s something you’ll notice every time you shop. The next time you’re in Target or Walmart, remember: the economic wild card of tariffs is closer to home than you might think.

2. Lost in Translation: What’s a Tariff, Really? (And Are You Paying It?)

Let’s be honest—tariffs are everywhere in the news, but if you’re like most people, you might not be totally sure what they actually are. You’re not alone. As one expert put it,

“I think about 50% of people have no idea what a tariff is.”

(6.10-7.12). Even among well-educated friends, the confusion is real. In fact, research shows only about 5% of the general public can clearly explain what a tariff is or how it works (7.17-7.24).

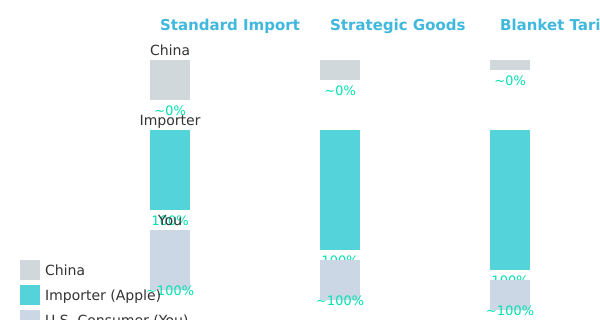

So, what is a tariff? In the simplest terms, think of a tariff as an international version of sales tax. When a product—say, an iPhone made in China—arrives at a U.S. port, it’s not China that pays the tariff. It’s Apple, the American company importing those iPhones (7.41-8.02). The idea that “China pays” is one of the biggest misunderstandings out there. Sure, sometimes the manufacturer might offer a discount to offset the tariff, but the one actually writing the check is the importer—Apple, in this case.

Here’s where the tariffs vs sales tax analogy helps. When you buy something at a store in the U.S., you pay a sales tax—usually 6-10%. The store collects it, but you’re the one who ultimately pays. Tariffs work similarly. Even if the tax is technically charged to the importer, the cost almost always gets passed on to you, the consumer. It’s right there on your receipt, just like sales tax (8.46-9.09).

Let’s break it down with a real-world example. Imagine Apple imports iPhones from China. With some tariffs currently as high as 125-145% (8.29-8.32), Apple would have to pay the 145% tariff when those phones arrive at the U.S. shore. As the transcript says,

“Apple would have to pay the 145% when it arrives at the shore.”

(8.39-8.43). But Apple isn’t just going to eat that cost—they’ll raise the price of the iPhone, and you’ll pay more at checkout. That’s the tariffs impact explained in plain language.

So why do tariffs exist at all? Sometimes, they make sense—especially for national security or during a crisis. Take the COVID-19 pandemic: the U.S. realized it was almost entirely dependent on imported N95 masks, which created huge vulnerabilities. In those cases, a strategic tariff can encourage domestic production or protect critical supply chains. But as a blanket policy, research indicates tariffs can backfire, leading to higher prices and even trade wars.

There’s also a persistent myth that someone else—somewhere far away—is footing the bill for tariffs. The truth? There’s no free lunch in global markets. Whether it’s Apple, your local store, or the government, the cost almost always finds its way back to you.

This chart illustrates who actually pays the tariff in different scenarios. No matter how you slice it, the cost lands on the importer and, ultimately, you—the consumer. The myth that tariffs are paid by foreign countries just doesn’t hold up, especially when you look at your own receipts.

3. Money Mindset: Why Getting Rich Isn’t Just About Numbers

When you think about achieving financial freedom, it’s easy to imagine it’s all about earning more or finding the perfect investment. But as you’ll quickly discover, the real secret lies in your financial freedom mindset (0.24-0.26). It’s not just about the numbers in your bank account—it’s about how you think, behave, and react to money challenges.

‘It is largely a mindset. You have an obligation to understand how money works.’ (0.26-0.28)

Let’s be honest: most of your money education doesn’t come from textbooks or formal classes. Instead, it’s learned through trial and error—sometimes the hard way. Research shows that the best psychology of money lessons often come from experiencing setbacks or even outright failures (0.33-0.36). Maybe you’ve lost money in a downturn, or watched your savings dwindle during a tough patch. These moments sting, but they’re also powerful teachers.

Why Saving Isn’t “Wasted”—It’s Real Control

There’s a common myth that saving money is just letting it “sit there, wasted” (0.40-0.42). But here’s the truth: having a financial cushion is about control. When the economy takes a nosedive or a recession hits, savings give you the power to support yourself and your family without panic (0.42-0.47). That sense of control is priceless, especially when everything else feels uncertain. Studies indicate that emergency funds and patience guard against financial volatility, making you more resilient in tough times.

Personal Aside: The Lifeline of an Emergency Fund

Think back to a time when you faced an unexpected expense—a job loss, a medical bill, or even just a string of bad luck. If you had an emergency fund, you know the relief it brings. It’s not about the exact amount, but the safety net it provides. That’s real peace of mind, and it’s why saving is never wasted.

The “Bad Answer” to How Much to Save

Here’s a question you’ve probably Googled: “How much should I save?” The reality is, there’s no magic number (0.50-0.54). It depends on your life, your needs, and your goals. What matters more is your patience and endurance. The wealthiest people in history didn’t get rich overnight—they stayed the course, even when it was tough (0.56-1.03). That’s the heart of investing patience advice: stick with your plan, and let time do the heavy lifting.

Lessons from the Wealthy: Patience Over Perfection

Look at any long-term investor or self-made millionaire. What sets them apart isn’t luck or a secret formula—it’s patience. They ride out the ups and downs, learning from mistakes and staying focused on the long game. Research shows that long-term investors are more successful than impatient ones.

| Insight | What It Means |

|---|---|

| 53% of audience not subscribed | Patience and consistency are rare, but they pay off in the long run |

| Long-term investors more successful | Endurance and discipline beat quick wins and impulsive moves |

So, if you’re aiming for real wealth, remember: it’s not just about numbers. Your mindset, your patience, and your willingness to learn from setbacks are what truly set you up for financial freedom.

4. Compounding Interest: The Invisible Engine in Your Wallet

When it comes to wealth building strategies, there’s one concept that quietly outperforms all the rest: compound interest. Yet, as you’ll discover, it’s also one of the most misunderstood ideas in personal finance (see transcript 1.09-1.12). If you want to invest smart and set yourself up for long-term success, understanding compound interest basics is essential.

Why Compound Interest Is So Misunderstood

Let’s be honest—compound interest doesn’t sound exciting. It’s not flashy, and you won’t see instant results. But that’s exactly why it’s so powerful. Research shows that small, disciplined financial choices can have exponential results over time thanks to compounding. Still, most people severely underestimate its impact, often focusing on short-term gains or quick wins instead.

Warren Buffett’s $10,000 Haircut: A Lesson in Opportunity Cost

To make this real, let’s borrow a quirky example from Warren Buffett. According to the transcript (1.14-1.19), Buffett was famously reluctant to spend money on things like haircuts. Why? Because he saw every dollar spent today as a missed opportunity for future growth. In his mind, “

If he invested that money and leave it alone for 50 years, in his mind, a haircut would cost $10,000.

”

That’s not just a fun anecdote—it’s a vivid illustration of how small, regular expenses can balloon over decades if you let compound interest work its magic. Imagine skipping a $20 haircut and investing that money instead. Over 50 years, with steady returns, that single haircut could indeed be worth thousands. Now multiply that by every small expense you routinely make, and the numbers become staggering.

The Cost of Small, Regular Expenses

It’s easy to dismiss the impact of a daily coffee or a streaming subscription. But when you understand compound interest basics, you realize these aren’t just minor indulgences—they’re missed opportunities for your future self. Studies indicate that the psychological hurdle is real: it’s hard to see the value in small actions compounded over decades. But the math doesn’t lie.

- Skip a $5 weekly treat and invest it instead? That’s $260 a year.

- Let it compound at 7% annually for 30 years, and you’re looking at over $26,000.

It’s not about deprivation—it’s about making conscious choices that align with your long-term goals.

Leaving Money Invested vs. Chasing Short-Term Gains

Another key to invest smart is resisting the urge to tinker with your investments. The real power of compounding comes from leaving your money alone and letting time do its thing. Chasing short-term gains or trying to time the market often leads to missed opportunities and unnecessary stress.

Tiny Changes, Big Results

The hidden lesson here? Tiny changes today can mean big numbers tomorrow—if you let time and compounding work for you. Whether it’s skipping a small expense or simply staying the course with your investments, the invisible engine of compound interest is always working in the background. The earlier you start, and the more consistent you are, the more dramatic the results.

5. When Tariffs Make Sense (And When They’re a Financial Disaster)

Tariffs are one of those economic tools that spark endless debate, but the truth is, they’re not always good or bad. The real story is more nuanced—and if you look closely, you’ll see why blanket tariffs risks are so widely criticized by economists, while targeted tariffs sometimes make perfect sense (9.15-9.16).

Strategic Tariffs: When Protection Makes Sense

Let’s start with the obvious: there are moments when tariffs are not just useful, but necessary. Think back to the early days of COVID-19. The United States found itself almost entirely dependent on other countries—mainly China and Korea—for N95 masks (9.20-9.27). When a crisis hit, suddenly, we needed hundreds of millions of masks, and they were all made somewhere else. That’s a classic example of supply chain disruptions causing real problems. In cases like this, research shows that a well-placed tariff on medical masks could encourage domestic production, making sure you’re not left vulnerable in a crisis (9.41-9.48).

The same logic applies to military equipment. Imagine going to war and relying on another country for your bullets, bombs, or tanks. It’s not just risky—it’s unthinkable. Tariffs here can help ensure critical industries stay at home, boosting national security (9.50-9.59).

Blanket Tariffs: The Economic Processed Sugar

But here’s where things get tricky. While strategic tariffs can be smart, blanket tariffs—those applied across the board to all imports—are a different story. Economists almost universally warn against them. In fact, the analogy often used is that blanket tariffs are to the economy what processed sugar is to your diet: nobody recommends them universally, and overuse leads to disaster (9.20-9.39).

There’s endless debate among economists about tax rates, subsidies, and market interventions. But, as the transcript puts it,

‘No serious economist thinks that you should have a trade war.’

(10.53-10.55). The consensus is clear: trade wars and blanket tariffs rarely, if ever, deliver the promised return of manufacturing jobs. Instead, they tend to raise prices, disrupt supply chains, and spark retaliation from trading partners (10.03-10.19).

History’s Warning: The Great Depression Tariffs

If you want proof, look no further than the Great Depression. In the early 1930s, the U.S. imposed massive tariffs, hoping to protect domestic industries. The result? Global trade collapsed, and the economic downturn only deepened (11.00-11.08). It’s a textbook example of how overreliance on trade barriers can backfire—something economists and historians agree on.

| Scenario | Tariff Use | Outcome |

|---|---|---|

| COVID-19 Medical Masks | Selective (on masks) | Encourages domestic production, reduces supply chain disruptions |

| Military Equipment | Selective (on gear) | Boosts national security, avoids reliance on foreign suppliers |

| Great Depression (1930s) | Blanket tariffs | Deepened economic downturn, shut down global trade |

What Everyone Can (Almost) Agree On

Just like dieticians all agree that processed sugar is bad, economists agree that blanket tariffs risks are real and damaging. Strategic, selective tariffs? Sometimes necessary. But history and research indicate that going too far with trade barriers—especially during uncertain times—can turn a challenge into a full-blown financial disaster.

6. The Psychology of Greed, Fear, and Envy: Why We Self-Sabotage Financially

When you think about money, it’s easy to assume that success comes down to crunching numbers, understanding formulas, or memorizing economic data. But if you look closer, you’ll see that the real story is much more complicated—and much more human. The biggest behavioral finance mistakes rarely come from a lack of technical know-how. Instead, they’re rooted in the psychology of money lessons that most people never learn in school.

As highlighted in the transcript (3.27-3.29), “psychological stuff with money is everything.” It’s not about whether you can calculate compound interest by hand or recite stock market statistics. The real challenge is managing your own emotions—especially feelings like impatience, envy, and greed. In fact, as the transcript puts it so simply:

“So many money problems in the real world have to do with impatience, envy, greed. That’s it.”

(3.33-3.37)

Think about it. How many times have you made a financial decision not because you lacked information, but because you felt left behind, anxious, or just wanted more—right now? Maybe you’ve watched a friend or neighbor make a quick profit and felt that twinge of envy. Or perhaps you’ve seen the market surge and, driven by greed or impatience, jumped in at the top—only to panic and sell at a loss when things turned south. I’ve been there myself: that moment when I bought high, sold low, and learned the hard way that regret is a powerful teacher.

Research shows that human behavior creates most finance issues, not a lack of know-how. Studies in behavioral finance indicate that even people with advanced knowledge can fall victim to emotional traps. You can be a money genius on paper, but still trip up in real life if you don’t recognize your own psychological pitfalls. It’s not about intelligence—it’s about self-awareness and emotional discipline. These are the real skills that determine your financial wellbeing.

What’s striking is how timeless these lessons are. The transcript notes (4.05-4.12) that these psychological pitfalls—greed, envy, impatience—are as true a thousand years ago as they are today. The tools and markets may change, but the core challenges remain the same. If you look back through history, you’ll see the same patterns repeating: bubbles, crashes, and panics, all driven by the same basic human emotions.

So, why is this so important right now? Because no matter how much technology advances or how much financial education you have, the psychology of money lessons will always be at the heart of your financial decisions. Learning to manage your emotions often matters more than mastering market mechanics. In the end, it’s not the formulas or data that trip you up—it’s what’s going on in your head.

Understanding these behavioral finance mistakes isn’t just about avoiding losses. It’s about building the self-awareness and emotional discipline that lead to true financial wellbeing. And that’s a lesson worth learning, no matter how much the world changes.

7. The Butterfly Effect: How Small Decisions Ripple Through the Global Economy

When you think about global trade effects, it’s easy to imagine that only big, headline-grabbing decisions make a difference. But the truth is, even the smallest policy tweaks—like a new tariff or a minor regulation—can set off a chain reaction that stretches across continents and lands right in your local store. The global economy is far more fragile (and fascinating) than most people realize.

Consider tariffs. These are dramatic levers in the world of supply chain disruptions. A single change, even if it seems minor on paper, can have gigantic and immediate consequences. As one expert put it,

“You’re probably a matter of weeks away from empty shelves.”

(0.07-0.08). That’s not an exaggeration. Research shows that the impact of tariff changes can be visible in just a few weeks, with consumers suddenly facing empty shelves or skyrocketing prices.

Let’s look at a real-life example that played out during the early days of COVID-19. At the time, the United States was “virtually 100% reliant on mass N95 masks that were made in China and Korea and not in the United States” (9.20-9.29). When the pandemic hit, the need for hundreds of millions of masks was immediate and desperate. But because production was concentrated overseas, a sudden surge in demand—and any small disruption in trade policy—meant that supplies dried up almost overnight. The result? Local stores saw prices soar, and many people couldn’t find masks at all. This is a textbook case of how supply chain disruptions, triggered by seemingly small decisions or events, can have a massive consumer impact.

Maybe you’ve experienced this butterfly effect yourself. Think back to the time you ordered something online, expecting it in a week, only to wait months for delivery. You might have traced the delay back to a single shipping disruption—a port closure, a new customs rule, or a sudden tariff. What seems like a tiny hiccup in the global system can ripple all the way down to your doorstep.

Why does this happen? The global economy is interconnected in ways that aren’t always visible. A policy change in one country can create disproportionate chaos or relief in another. For example, a tariff on a single product can make it unprofitable for foreign manufacturers to export, leading to shortages and price hikes at home. Studies indicate that these tiny policy shifts can yield massive economic consequences, and the average consumer feels the effects rapidly—not gradually.

All of this demonstrates just how granular economic decisions play out in real-world disruptions and delays. The next time you see a price jump or an empty shelf, remember: it might all trace back to a decision made thousands of miles away. The butterfly effect isn’t just a theory—it’s the reality of global trade effects, supply chain disruptions, and consumer impact in our interconnected world.

8. Conclusion: Surfing the Economic Tsunami – What Can You, Personally, Do?

Let’s face it—tariffs, supply chain disruptions, and global economic shocks are not just headlines. They’re the waves that can rock your financial boat, sometimes without warning. You might feel tempted to tune out the noise, but as you’ve seen throughout this series, ignoring these forces isn’t really an option. Even if you don’t trade stocks or run a business, the ripple effects can reach your wallet in unexpected ways.

Recap: Tariffs Are Complicated, but Ignoring Them Isn’t an Option

Tariffs might sound like something only politicians or economists worry about, but they shape the prices you see at the store, the stability of your job, and the value of your investments. With supply chain disruptions becoming more common, it’s clear that the global economy is interconnected—and fragile. Research shows that being aware of these factors, rather than ignoring them, gives you an edge in protecting your finances.

Tips: How to Fortify Your Finances Against Unpredictable Global Waves

- Build a financial cushion: Set aside emergency savings. Even a small buffer can make a big difference when prices spike or jobs become less secure.

- Invest smart: Diversify your investments. Don’t put all your eggs in one basket—spread risk across different assets and sectors.

- Stay informed: Keep an eye on economic trends, but don’t let headlines dictate your every move. Balance awareness with action.

Mindset Shift: Forget Perfect Plans—Focus on Learning, Flexibility, and Preparation

Here’s the thing: no one has a crystal ball. You can’t predict every twist in the global economy, but you can prepare. Adopting a financial freedom mindset means focusing on what you can control—your habits, your savings, and your reactions. Studies indicate that practical preparation and emotional awareness trump reactive decision-making. In other words, don’t chase perfection. Instead, get comfortable with adapting as things change.

Your Two Missions: Emotional Triggers and Financial Cushion

- Understand your emotional triggers: When markets drop or prices rise, what’s your gut reaction? Recognizing your patterns helps you avoid panic-driven decisions.

- Build your financial cushion: Preparation beats prediction. Even small, regular savings can help you weather storms.

Closing Anecdote: Surviving the Downside

Let me leave you with this. My best financial move wasn’t some perfectly timed investment or a clever tax hack. It was simply surviving my worst financial moment—learning from it, adapting, and coming back stronger. As mentioned in the transcript (0.32-0.35),

‘You’re going to learn the best by experiencing the downside.’

Staying curious and adaptive is essential in today’s economic climate. Remember, your reaction to uncertainty—not the uncertainty itself—shapes your financial destiny. Embrace flexibility, keep learning, and invest smart. That’s how you surf the economic tsunami, not just survive it.

9. FAQ: Untangling Tariffs and Money Mindset

With tariffs dominating headlines and shaking up economies, it’s easy to feel overwhelmed by jargon and uncertainty. Here, we break down the most common questions to help you understand the tariffs impact explained—and how your financial freedom mindset can shape your response as a consumer.

What’s the real difference between a tariff and a tax?

At first glance, tariffs and taxes might seem interchangeable. Both are fees collected by governments, but their targets and effects differ. A tax is usually applied to income, property, or sales within a country, directly affecting citizens. A tariff, on the other hand, is a fee placed on imported goods. While companies like Apple pay tariffs at the border, research shows these costs are almost always passed on to you, the consumer, in the form of higher prices. So, while you may not see a “tariff” line on your receipt, you’re still footing the bill.

Are tariffs ever good for consumers?

Tariffs can sometimes help—like during emergencies when domestic production of essentials (think N95 masks during COVID) needs a boost. But blanket tariffs, especially those as high as 10% or more, rarely benefit everyday shoppers. History and economists agree: high tariffs often lead to higher prices, fewer choices, and even empty shelves. The consumer impact is usually negative, especially when global supply chains unravel.

How fast do tariff changes impact prices in stores?

Surprisingly quickly. When tariffs spike, importers and retailers react almost immediately. If a dress costs $9 more per unit due to tariffs, that cost is either passed to you or the product disappears from shelves. In some cases, trade simply stops—especially when tariffs reach extreme levels (like 125% or 145%). The result? Fewer goods, higher prices, and sometimes, empty aisles within weeks.

What’s the best way to prepare for financial shocks like a sudden trade war?

Preparation is key. Experts recommend building a savings cushion—more than you think you’ll need. Economic shocks, whether from tariffs, recessions, or pandemics, are inevitable. Having cash on hand, minimizing debt, and keeping your expenses flexible can help you weather storms. As the host emphasized, true wealth is about independence: the ability to make choices and support your family, even when the world feels unstable.

Does mindset really make that much difference in building wealth?

Absolutely. Studies indicate that a financial freedom mindset—valuing independence, contentment, and resilience—matters as much as income or investment returns. Stories of people living happily on modest means, or billionaires choosing simplicity, prove that psychological wealth often trumps financial wealth. Your mindset shapes your habits, your savings, and ultimately, your happiness.

Can I do anything to limit the impact of tariffs on my daily spending?

While you can’t control global trade policy, you can adapt. Consider buying less imported goods, supporting local businesses, or delaying big purchases when tariffs are in flux. Most importantly, focus on the big financial levers—housing, career, and savings—rather than obsessing over small daily expenses. Remember, your values and strategies matter more than any single economic policy.

In the end, understanding the tariffs impact explained and nurturing a financial freedom mindset gives you the tools to navigate uncertainty. The world will always feel unpredictable, but your approach—grounded in resilience, independence, and informed choices—can make all the difference for your financial future.

TL;DR: Tariffs aren’t just headlines—they’re about psychology, daily habits, and how prepared you are for financial storms. From the grocery aisle to global stock markets, understanding these forces helps you make smarter decisions—for your wallet and your sanity.

Hats off to The Diary Of A CEO for delivering such insightful content! Be sure to check it out here: https://youtu.be/uxu37dqVR90?si=vo8X5qGxfzIBy6N8.