Six years from now, will your savings actually secure your dreams—or just buy you a coffee? Thinking back to when I first thought a house and a fat savings account spelled safety, I now realize how naïve I was. Like finding out your trusted GPS is stuck recalculating in a tunnel, my view of ‘security’ hasn’t just been challenged—it’s been reprogrammed. In this post, we’re going to unravel how modern wealth is really built, why familiar financial advice won’t cut it, and what you can do (even if you’re not rich) to protect and grow your future. If you’ve ever felt the system was stacked against you, you’re not imagining it. But the plot twist? There are unexpected ways you can flip the script—if you know where to look. Ready? Let’s get uncomfortably honest.

Myths of Financial Safety: Why Banks, Houses, and Gold Aren’t the Fortress You Think

For decades, you’ve probably heard that putting your money in the bank, buying a house, or holding gold are the safest ways to secure your financial future. But in today’s world, these beliefs are more myth than reality. Let’s break down why these classic “safe” assets might not offer the financial security you expect—and how recent history has exposed the cracks in the foundation.

Bank Safety Myths: Is Your Money Really Safe?

It’s easy to assume that your savings are protected in the bank. After all, that’s what most of us were taught. But if you look closer—especially after the 2008 financial crisis—this sense of security starts to fade (0:03-0:07). As one expert put it:

“The moment you put your money and your savings in the bank, you don’t own anything, and your future self is getting poorer by 11% every year.”

That 11% figure refers to the annual loss in future value for savings, largely due to inflation and wealth erosion. Research shows that since 2008, bank deposits are not as secure as widely believed. The fine print matters: in several countries, your deposits can legally be used to pay off the bank’s debts if things go wrong. This is not just theory; it happened during the European financial crisis, when banks underwent “bail-ins” and savers’ money was seized to cover losses (3:29-3:48).

Real Estate Risks: The Changing Face of Home Ownership

Owning a home was once seen as the ultimate path to wealth and stability. But the landscape has shifted, especially for Millennials and Gen Z. Home ownership is now out of reach for many, and even those who do buy are not guaranteed financial security. During the 2008 and 2012 crises in Spain, entire communities saw their wealth wiped out as the real estate market collapsed (2:53-3:27). Friends and family lost everything, not because they made reckless bets, but because the system itself failed them.

Studies indicate that home ownership no longer guarantees economic safety. Prices can fall, liquidity can dry up, and sometimes, the dream of a “safe” investment becomes a nightmare.

Gold Investment Returns: More Loss Than Legacy?

Gold has a reputation as a timeless safe haven. But if you look at recent years, the reality is less impressive. Gold lost money as an asset class, and its performance has not matched its reputation for protecting wealth. While it’s often touted as a hedge against uncertainty, research shows that gold’s returns have lagged behind other asset classes, especially when adjusted for inflation.

Personal Stories: When the Fortress Fails

Firsthand experience can be the most powerful teacher. During the European crisis, I watched friends and family in Spain lose their life savings overnight. The government’s “bail-in” policy meant that ordinary people’s deposits were used to pay off bank debts, flipping savers into losers in an instant (3:29-3:54). The shock was real—and so was the loss of faith in the system (4:05-4:13).

Asset Safety vs. Performance & Accessibility

Asset Type

Perceived Safety

Actual Recent Performance

Accessibility

Savings in Banks

High

Declining (11% loss)

High

Housing

High

Volatile

Low

Gold

Medium

Poor

Medium

Crypto

Low

Volatile

High

Crumbling Ladders: The Statistical Truth Behind Millennial Wealth (and Why Your Parents Had It Easier)

If you’ve ever listened to your parents talk about buying their first home after college, you might feel like they’re describing a different planet. The reality is, they kind of are. The millennial wealth gap isn’t just a talking point—it’s a statistical landslide, and the numbers are hard to ignore. Let’s break down what’s really changed, and why affording a home is no longer a rite of passage, even for those with impressive salaries (see transcript 8.28-8.34).

Stark Stats: 30-Year-Olds Then and Now

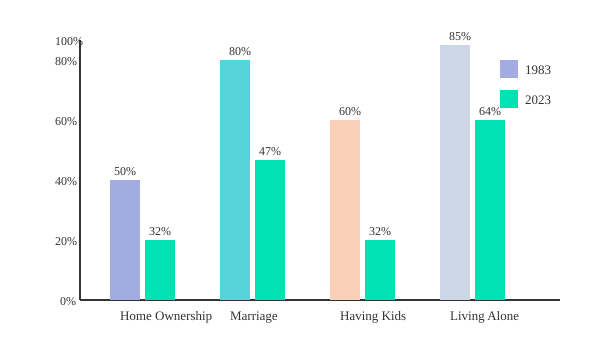

Back in 1983, the average 30-year-old had a much smoother path to financial independence. Research shows that 85% of 30-year-olds lived on their own, and 80% were married. Fast forward to 2023, and only 64% live independently, while marriage rates have dropped to 47% (transcript 10.06-10.45). The story is similar for other milestones: home ownership for 30-year-olds has plummeted from 50% to 32%, and having kids by 30 has fallen from 60% to 32%. These home ownership statistics and marriage rates by generation paint a clear picture of generational finance trends that have shifted dramatically.

Why Home Ownership Is Out of Reach

Here’s where the numbers get even starker. In 1983, a young investment banker could expect to pay about 3.5 times their annual salary for a home. Today, that figure has soared to 8 to 10 times salary (transcript 8.30-8.36). Even six-figure earners are finding themselves priced out, as inflation-adjusted wages have stagnated while housing costs have tripled. The dream of using your home as a stepping stone to wealth—an asset you can pass down or sell—has become much harder to achieve (transcript 8.41-9.06).

Delayed Independence and Shifting Priorities

With these barriers, it’s no surprise that more millennials are living with roommates or family well into their 30s. Starting a family is often delayed or abandoned, not out of choice, but necessity. Research indicates that these trends are direct consequences of the millennial wealth gap: fewer marriages, fewer children, and more shared living arrangements. The emotional impact is real—heightened anxiety, a sense of desperation, and a future that feels less secure than the one their parents enjoyed (transcript 9.47-10.01).

Anecdotal Reality: Your Parents’ Story Is Sci-Fi

Think about it: your parents may have bought a house on a single income, started a family, and built wealth with far less struggle. Today, that story sounds almost fictional. As one expert put it:

“This is the first generation that won’t be as rich as their parents, and that’s a weird thing because we’re all used to human progress.”

How Income and Inflation Sabotage Wealth-Building

It’s not just about houses. Millennials are juggling more jobs, more debt, and fewer assets. Many are working two, three, or even four jobs just to keep up (transcript 10.33-10.45). The generational finance trends are clear: the ladders to wealth that once seemed sturdy are now crumbling, and the statistics don’t lie.

The Unconventional Opportunity: Why Crypto Could Be a Game-Changer (But Not a Get-Rich-Quick Ticket)

When you look at traditional wealth-building options—like the S&P 500, real estate, or even gold—the landscape has changed dramatically in recent years. According to the transcript (0.54-1.00), these once-reliable assets are now often seen as underwhelming. The S&P 500 is described as “not worth your time,” real estate “doesn’t really make you any money,” and gold has actually lost value. In this environment, crypto investment strategies have emerged as a standout opportunity, offering a level of potential that’s hard to ignore.

Let’s talk numbers. Research shows that bitcoin returns have reached “stupidly high” levels, with growth rates of 150% per year—far outpacing almost every other asset class (1.02-1.08). In fact, crypto is scaling at twice the speed of the internet itself, according to Raoul Pal. Here’s a quick look at the data:

| Asset | Annual Growth Rate | Scaling Speed |

|---|---|---|

| Bitcoin/Crypto | 150% (cited) | 2x the speed of the internet |

But before you get swept up in visions of overnight riches, it’s important to ground your expectations. The transcript addresses a common fear: “Have I missed the boat?” (1.14-1.17). The answer is no. The cycle of regret and late adoption is real, but it’s not too late to participate—if you’re smart about it.

Cautious Optimism: Why Some Lost Their Shirts in Crypto

You’ve probably heard the horror stories—people who “put too much in and they’ve lost it all” (1.20-1.23). This is where risk in crypto becomes a critical topic. The truth is, crypto’s volatility can be brutal. Some have made fortunes, but others have lost everything by betting the farm. The lesson? Don’t gamble more than you can afford to lose. Research indicates that while crypto offers high-yield potential unmatched by other asset classes, it comes with increased risk.

Real Talk: Start Small, Think Big

Here’s where things get interesting. Unlike traditional investments, you don’t need a massive bankroll to get started. The transcript points out that even “the guy with $500 can get rich” (1.10-1.13). Participation doesn’t require substantial capital—small investments can go a long way. This is a game-changer for anyone who’s felt locked out of wealth creation in the past.

“Investing in crypto like Bitcoin gives us stupidly high returns in shorter periods of time, growing at 150% a year, scaling at twice the speed of the internet.”

Crypto vs. The Internet: A New Era of Growth

It’s hard to overstate how quickly crypto is moving. Scaling at twice the speed of the internet means opportunities are appearing—and disappearing—faster than ever before. If you’re considering crypto investment strategies, now is the time to educate yourself, start small, and manage your risk.

Storytime: Rethinking Risk and Reward

The first time I tried crypto, I was skeptical. I started with a small amount—less than $500—just to see what would happen. The volatility was nerve-wracking, but it forced me to rethink everything I knew about risk and reward. That’s the real lesson here: crypto isn’t a get-rich-quick ticket, but it’s an unconventional opportunity that rewards those who approach it with caution, curiosity, and a willingness to learn.

Macro Mindset: Seeing the Big Picture When Everything Feels Broken

When you hear the word macro, what comes to mind? In the world of finance and economics, “macro” refers to the big-picture trends that shape our lives—global forces that influence everything from your paycheck to your ability to buy a home (7.00-7.05). Understanding these macro investing insights is more important than ever, especially when the world feels chaotic and personal progress seems impossible.

What Does ‘Macro’ Really Mean—and Why Should You Care?

At its core, macro is about perspective. It’s stepping back to see the forest, not just the trees. The macro lens asks: What are the large-scale trends that could impact your future? For most people, the answer is clear—wages, adjusted for inflation, haven’t meaningfully increased in decades (7.18-7.23). This reality has left many treading water financially, even as the cost of living continues to rise.

The Root of Much Unhappiness: Mismatch Between Expected and Actual Futures

Think about the stories you grew up with—the American Dream, the promise that hard work would lead to a comfortable life, a nice house, and a secure retirement (7.26-7.54). For most, this narrative no longer matches reality. Research shows that wage stagnation and rising costs have fundamentally altered the path to wealth. Your savings don’t stretch as far as you hoped, and the dream of retiring on a cruise ship feels more like fantasy than fact.

| Macro Trend | Past Narrative | Current Reality |

|---|---|---|

| Wages (Adjusted for Inflation) | Steady growth, rising prosperity | Flat for decades, limited upward mobility |

| American Dream | Home ownership, secure retirement | Out of reach for many, increased financial anxiety |

Occupy Wall Street, Wage Stagnation, and the Invisible Hand

Movements like Occupy Wall Street didn’t appear out of nowhere. They were fueled by frustration over invisible, misunderstood macroeconomic forces. When you can’t see the big picture, it’s easy to feel powerless. Social discontent often arises when people sense that the system is rigged, but can’t quite put their finger on why (7.33-7.37).

Zooming Out: How a Macro Mindset Can Change Your Financial Outlook

It’s easy to panic over headlines or feel overwhelmed by day-to-day setbacks. But learning to zoom out—to see the macro trends—can help you regain control. When you understand that many challenges are systemic, not personal, you can start to adapt your financial mindset and look for new approaches. As one expert puts it:

“Does your vision of your future self match where you are today? Can you see that path? Whether that’s finances or health, they’re all very similar journeys.”

Why Finance Is More About Mindsets Than Numbers

Here’s the unfiltered truth: finance isn’t just about cold numbers. It’s about memes, mindsets, and behavior. The stories we tell ourselves—about money, success, and the future—shape our actions. If you can align your expectations with macro reality, you’re already ahead of the curve. Studies indicate that understanding macro trends is crucial to adapting and finding new approaches in a shifting world.

From Surviving to Thriving: Your Playbook for the Next Six Years

Let’s get real about wealth creation tips in today’s world. You don’t need to be born into money to build a future—you need strategy, grit, and a willingness to adapt. The rules have changed, and so has the game. If you’re a millennial or Gen Z, the next six years are your window to move from just surviving to truly thriving. Here’s what that playbook looks like, unfiltered and practical.

Income: The Foundation of Every Wealth Journey

Research shows that maximizing and diversifying your income early is the first step to wealth (12.55-13.02). Without income, you simply don’t have the cash to invest, seize opportunities, or weather unexpected storms. But here’s the twist: the nature of income is shifting. Gone are the days when a single job at a big firm was the golden ticket (13.09-13.16). Today, income strategies are all about multiple income streams—side hustles, freelance gigs, entrepreneurial projects. It’s not just a buzzword; it’s a necessity.

- Traditional jobs are less reliable—layoffs, automation, and economic shifts are the new normal.

- Side hustles and entrepreneurship are on the rise, offering flexibility and extra security.

So, if you’re wondering where to start, focus on building as many income streams as you can handle. It’s the most practical career advice for millennials right now.

The 20s Grind: Your Unfair Advantage

There’s a hard truth here: your twenties are for grinding. It’s the time to do “everything”—work day and night, try different jobs, start side projects, and yes, fail often (13.22-13.31). As one expert puts it:

“If you’re in your 20s, do all of that, work day and night, really do as many things, learn as much as you can, fail as often as possible.”

Why? Because every failure is a lesson. Every side hustle, even the ones that flop, adds to your financial armor. Studies indicate that learning through failure in your 20s is crucial for long-term financial success. It’s messy, but it’s how you build the skills and resilience you’ll need in your 30s—a decade that’s critical for your wealth trajectory.

Work-Life Balance: Not Yet

It’s tempting to chase balance early on, but research shows that work-life balance should be a future goal, not your starting point (13.31-13.40). The early years are for building skills, networks, and income. The payoff? Once you’ve laid the groundwork, you’ll have more freedom to step back and enjoy life later.

Travel, Side Hustles, and Rough Patches: Building Your Financial Armor

Don’t underestimate the power of travel after university (13.44-13.51). Taking a year or two to see the world broadens your perspective in ways no classroom or office can. It’s not a detour—it’s valuable career and investing experience. And those rough patches? They’re not setbacks; they’re part of your story and your growth.

In short, the next six years are about relentless learning, building multiple income streams, and embracing every challenge as a step toward thriving. The world is shifting, but with the right playbook, you can shift with it.

Unlocking World-Class Knowledge Without Wall Street Access

Imagine a world where the sharpest financial minds—those who once operated behind closed doors on Wall Street—now share their insights openly, directly with you. That’s the revolution Real Vision finance has sparked. No longer do you need an Ivy League degree or an insider’s badge to access high-end financial education. Instead, platforms like Real Vision are breaking down barriers, making financial wisdom accessible to everyone, not just the privileged few.

How Real Vision and Democratized Finance Content Make a Difference

According to the transcript (5.03-5.07), Real Vision’s mission has always been about interviewing people at the very heart of the system and sharing their knowledge. These experts aren’t hiding secrets—they want to help. The result? A new era of democratized investing, where information is power and that power is finally being shared.

Research shows that previously exclusive financial wisdom can now empower everyday investors, leveling the playing field. When you have access to the same insights as institutional players, you’re no longer left guessing. You can make smarter decisions, avoid common pitfalls, and even spot opportunities before they hit the mainstream.

If Info Is Power, Democratizing Insight Closes the Gap

For decades, institutional research was locked away, reserved for hedge funds and big banks. Now, as Real Vision launched to bridge the expertise gap for regular investors, the landscape is shifting. You’re no longer on the outside looking in. This shift isn’t just about access—it’s about equity. It’s about giving you the tools to understand why markets move, why politics feels so polarized (5.24-5.32), and what’s really driving global change.

Why Sharing Wisdom from the Heart of the System Truly Matters

There’s something powerful about hearing directly from those who shape the system. As the transcript notes (5.05-5.13), many insiders genuinely want to help. They’re not just sharing data—they’re sharing context, stories, and lessons learned the hard way. This kind of transparency has a ripple effect: it inspires trust, encourages learning, and helps regular people feel less overwhelmed by the complexity of finance.

The Ripple Effects of One Viral Article

Sometimes, all it takes is one piece of research going viral to change lives. A single article, shared at the right moment, can spark a new career, shift someone’s perspective, or even inspire a movement. That’s the power of virality and broad reach—education and opportunity can spread in ways that were unimaginable just a decade ago.

Memes, Memes Everywhere: The Power of Simple Language

Let’s not underestimate the impact of meme finance. Straightforward, meme-friendly language breaks down intimidating concepts into something relatable and actionable. When complex ideas are distilled into simple, shareable formats, more people engage, learn, and act. As Real Vision puts it,

“We’ve helped demystify the world of finance…”

—and sometimes, a meme can teach you more in seconds than a textbook can in hours.

The importance of making deep financial knowledge widely available cannot be overstated. With platforms like Real Vision, the transformation in financial education for non-insiders is just getting started.

Wild Cards & Future Shock: What If We’re All Wrong (and Other Hypotheticals)

In today’s world, investing uncertainty is the only constant. You might spend years building a plan—only to watch it unravel overnight if crypto fizzles, the market shifts, or government policies change without warning. If you’re in your 30s, this probably feels all too real. As the transcript (7.08-7.45) points out, wages adjusted for inflation haven’t risen for decades. The classic promises—steady savings, a comfortable pension, maybe a cruise in retirement—are slipping further out of reach for most people.

So, what do you do when nothing is bulletproof? You focus on personal resilience. Research shows that open-minded adaptability outpaces rigid plans in a rapidly changing world. It’s not just about what you own, but what you can do. Having a variety of skills, not just assets, may be your ultimate hedge. If the rules of the game change, your ability to pivot—whether that means picking up freelance work, learning new tech, or even moving to a new city—becomes your safety net.

Time-Travel Finance: What Would Your Future Self Say?

Imagine you could get advice from your 60-year-old self. What would they warn you about? Maybe they’d say: Don’t count on any one investment, no matter how hyped it is. Or perhaps: Don’t ignore the small, steady habits that build real security over time. The transcript (7.47-8.22) highlights how home ownership, once a cornerstone of future proofing strategies, is now out of reach for many. That same house that used to cost three and a half times your salary might now be eight or ten times as much. The rules have changed, and so must your approach.

The Meme Effect: Simple Ideas, Big Impact

There’s a strange power in the way finance memes spread. The “American Dream” is a meme—an idea that’s simple, sticky, and viral (7.28-7.33). But as the transcript reveals, it’s not reality for most. Still, these viral concepts shape how we think, what we chase, and even how we invest. Studies indicate that simple, memorable ideas may be the most valuable financial lessons. When you see a meme about “buying the dip” or “diamond hands,” remember: these aren’t just jokes. They’re shaping mass psychology, sometimes for better, sometimes for worse.

Security vs. Risk: The Emotional Rollercoaster

Chasing security in this environment can feel like a never-ending ride. The transcript (8.23-10.45) lays out the facts: Millennials and Gen Z are buying fewer homes, delaying marriage, and working multiple jobs just to keep up. It’s not because they want to grind seven days a week—it’s because the old paths to security are blocked. You might feel desperate, anxious, or just plain tired. But here’s the thing: “There are options… you just need to know where to look.”

In a world where investing uncertainty is the norm, your best future proofing strategies are adaptability, skill-building, and a healthy dose of skepticism. Stay open-minded, keep your ideas simple, and remember that sometimes, the wild cards are what shape your future most.

Conclusion: Rethinking Progress—And Taking Action While the Clock’s Still Ticking

Let’s face it—what worked for building wealth in the past just doesn’t cut it anymore. If you’ve ever felt like the old money rules are broken, you’re not alone. As discussed around 12.13-12.17 in the transcript, it’s becoming more and more difficult for younger generations to follow the same path as those before them. But here’s the thing: while the old playbook might be outdated, it’s not the end of the story. You have the power to rewrite it, and that’s where the future of money really starts to shift.

There’s no denying the pain points in today’s economy. Rising living costs, unpredictable job markets, and the constant pressure to “keep up” can feel overwhelming. But if you look a little closer, you’ll see that these challenges also create windows of opportunity—especially for those who are nimble and willing to adapt. The landscape is tough, but it’s not hopeless. In fact, research shows that the people who thrive are often the ones who spot change early and act before the crowd catches on.

So, what does actionable finance look like in this new era? It’s about more than just saving or investing the way your parents did. It means questioning assumptions, seeking out new tools, and learning from a wider range of sources. Whether you’re starting with a side hustle, exploring digital assets, or simply rethinking your spending habits, the key is to move quickly and stay curious. The next six years are being called a transformational time horizon for a reason—what you do now could define your financial trajectory for decades to come.

Modern finance is risky, yes. But it’s also full of high-reward opportunities for those who are ready to adapt. Studies indicate that younger generations, in particular, face a rapidly changing landscape where waiting is actually the biggest risk. If you’re hoping to redefine success on your own terms, you can’t afford to sit on the sidelines. The clock is ticking, and the window to act is wide open—but it won’t stay that way forever.

Wherever you’re starting from, remember: finding your future is about looking wider, learning faster, and acting sooner rather than later. Don’t get stuck trying to replicate a version of success that no longer exists. Instead, challenge the broken assumptions, seize new opportunities, and chart your own course. The future of money isn’t just about numbers—it’s about mindset, adaptability, and the courage to move when others hesitate.

“Ready to unfuck your future? Start before someone else does it for you.”

This is your rallying cry. The next six years could define not just your finances, but your entire approach to life and success. Don’t let the moment pass you by—take action, redefine what progress means to you, and embrace the future of money on your own terms.

FAQs: Your Burning Questions About the New Rules of Wealth

When you’re just starting out, especially in your mid-20s or younger, the world of wealth-building can feel overwhelming. You might wonder if you’ll ever be able to break out of the cycle of working multiple jobs, living paycheck to paycheck, or feeling like you have nothing to show for your hard work (see transcript 12.24-12.43). These are real anxieties, and you’re not alone in asking: Where do I even begin?

Do I Have to Be Wealthy to Start Investing in Crypto or New Assets?

Absolutely not. The idea that you need a hefty bank account to start investing is outdated. Many platforms now let you begin with just a few dollars, whether it’s crypto, stocks, or other emerging assets. Research shows that beginner investing is all about consistency and learning, not about having a huge sum to start. The key is to start small, learn as you go, and never invest more than you can afford to lose. Even tiny steps can compound over time—knowledge is the real bridge to building wealth.

What’s the Safest First Step for Someone With Only a Little to Spare?

If you’re worried about risk, your first move should be to build a small emergency fund. This is the foundation of all saving strategies. Even $10 or $20 a week adds up. Once you have a safety net, consider low-cost index funds or fractional shares, which let you invest in the market without needing a fortune. Many apps now make this process accessible and unintimidating for beginners. Remember, the goal isn’t to get rich overnight—it’s to build habits that last.

Are There Alternatives to Home Ownership for Building Long-Term Wealth?

Home ownership has long been seen as the gold standard for wealth, but it’s not the only path. Renting while investing the difference, exploring REITs (real estate investment trusts), or even investing in digital assets are all valid alternatives. The landscape is shifting, and flexibility can be an asset in itself. What matters most is that you’re consistently putting money to work for you, rather than letting it sit idle.

What’s the One Macro Trend to Watch This Decade?

If you’re looking for macro trends to watch, pay close attention to the intersection of technology and finance. Decentralized finance (DeFi), AI-driven investing, and the digitization of assets are reshaping how wealth is created and managed. Staying curious about these trends—and being willing to adapt—can give you a real edge as the world changes.

How Can I Keep Learning Without Getting Overwhelmed by Information Overload?

It’s easy to feel swamped by advice, news, and endless opinions. The trick is to pick a few trusted sources and stick with them. Set aside regular, manageable time each week to learn—maybe 20 minutes on Sunday evenings. As you build your knowledge, you’ll find it easier to filter out the noise and focus on what matters to you. Remember, you don’t have to know everything to get started. Progress, not perfection, is the goal.

In the end, anyone can start building wealth with small, strategic steps. The rules may be changing, but the most important thing is to begin—right where you are, with what you have. The future is uncertain, but your actions today can reinvent your tomorrow.

TL;DR: The world of money is changing fast, and old formulas for wealth just won’t work anymore. But if you learn the right strategies—especially around income, unconventional investing, and macro trends—you can still build a future worth looking forward to. Don’t let outdated myths trap you; seek the new opportunities.

A big shoutout to The Diary Of A CEO for their enlightening content! Be sure to check it out here: https://youtu.be/XyhhwVJB9Z4?si=7Q1jeO4YOG7trS7J.