What if I told you a supermarket watermelon could lead you straight into a story of lost empires, ecological disaster, and the next big resource rush beneath the waves? Let me set the scene: I once griped about shelling out $8 for a melon, then stumbled across a photo of another that cost $61 in a far-off world called Nauru. Ever spiral down a rabbit hole over something as mundane as fruit? Well, buckle in—because Nauru’s journey involves empires, bird poop, wild get-rich-quick schemes, and a new-age gold rush for metals deep underwater.

Section 1: The $8 Watermelon That Launched an Investigation

Sticker Shock at the Fruit Stand

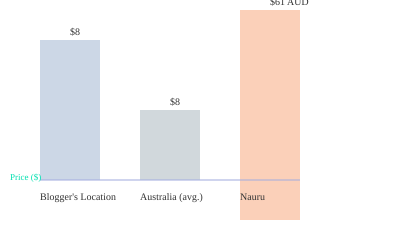

Ever looked at a price tag and thought, “Wait, am I really about to pay this much for fruit?” That was me, standing in the grocery store, eyeing a watermelon for $8. “I just bought this watermelon for like $8. Maybe a little expensive to pay for a watermelon, but not bad.”

But then I stumbled across something that made my $8 seem like pocket change. A photo online—just a simple supermarket shelf—showed a watermelon with a price tag: $61 AUD (about $37 USD). For a single watermelon.

Where on Earth Is Nauru?

That watermelon wasn’t in New York or Tokyo. “This photo was taken right here in this supermarket on this island, a country called Nauru that sits in one of the most remote patches of the South Pacific.”

Nauru. Ever heard of it? Most haven’t. It’s a tiny island nation, just 21 square kilometers, floating in the vast Pacific. No big cities. No highways. Just ocean, sky, and a handful of shops.

Why Does Fruit Cost So Much on Remote Islands?

- Isolation: Nauru is thousands of kilometers from major suppliers. No quick truck deliveries here.

- Supply Chains: Everything arrives by boat or plane. That means big shipping costs.

- Local Agriculture: Nauru’s land is stripped from decades of phosphate mining. Growing crops? Nearly impossible.

- Dependency: The island relies almost entirely on imports for food, especially fresh produce.

So, a watermelon isn’t just a fruit—it’s a luxury. A symbol of how far things have to travel, and how much it costs to live at the edge of the world.

How One Odd Receipt Opens a World of History

It’s funny how a single receipt can spark curiosity. Why is fruit so expensive? What happened to Nauru’s farmland? How does a nation survive when it can’t grow its own food? Sometimes, a $61 watermelon is more than a sticker shock—it’s a clue to a much bigger story.

- $8 watermelon (unspecified location)

- $61 AUD ($37 USD) watermelon in Nauru

- Distance from suppliers: thousands of kilometers

- Local crops: Nearly impossible to grow

Section 2: How Bird Poop Built an Empire and Made Nauru Rich—Until It Didn’t

How Did Seabirds Make Nauru Wealthy?

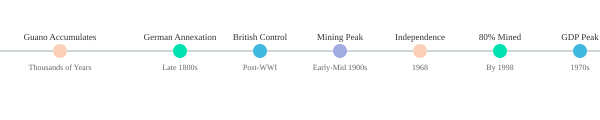

Imagine a tiny island in the middle of nowhere. For thousands of years, seabirds used Nauru as a pit stop. They left behind droppings—layer after layer. Not the prettiest image, but over centuries, these white mounds hardened and chemically transformed into something valuable: phosphate.

Why does this matter? Because phosphate is gold for farmers. It’s the magic dust that makes crops grow. Without it, modern agriculture would be, well, stuck in the dirt.

From Guano Mountains to Global Fertilizer

- Bird droppings (guano) pile up for millennia.

- Over time, they turn into high-grade phosphate rock.

- This rock becomes the world’s go-to fertilizer.

It’s wild to think: the food on your table might trace back to ancient seabird poop from a remote Pacific island.

The Colonial Carve-Up: German, Then British Hands

- Late 1800s: Germany annexes Nauru. They bring disease and disruption, like colonial powers did everywhere.

- Early 1900s: British take over after World War I. They see the value in those white phosphate mountains.

- Industrial mining begins. British companies ship out hundreds of thousands of tons every year.

The locals? Mostly left out of the profits. The land? About to be changed forever.

Phosphate-Fueled Prosperity—And the Crash

- By 1968, Nauru gains independence. Suddenly, the islanders control the phosphate trade.

- For a brief, dazzling moment in the 1970s, Nauru has the second highest GDP per capita in the world—right behind Saudi Arabia.

- But there’s a catch. Mining strips away 80% of the island. What’s left? Jagged limestone spires. Barren land. No trees, no crops. Just scars.

The World’s Farms Depended on Nauru’s Ancient Droppings

One historian summarizes it by saying, ‘Without access to phosphate, neither Australia nor New Zealand would have been able to establish the industrial agricultural systems that were fundamental to their demographic, economic, and societal expansion.’

Nauru’s phosphate didn’t just make a few people rich. It fed entire nations. But the price? The island’s own future.

Section 3: Paradise Lost—When Riches Turn Toxic

What Happens When the Gold Rush Ends?

Imagine waking up one morning and finding your home turned into a wasteland. That’s not a metaphor for Nauru—it’s reality. After decades of phosphate mining, the island was left scarred and barren.

The phosphate was totally depleted. And where once there was lush island vegetation, now stood only desolate, jagged limestone spikes, some up to 15 m high.

You can still see it on satellite images. The center of Nauru is a maze of white, sharp rocks. Coconut trees and green fields? Gone. Just a memory.

The Broken Promises of Sudden Wealth

For a while, Nauruans were rich. Really rich. Suddenly, there were cars, imported foods, and even luxury homes. But money like that—when it comes fast—can disappear even faster.

- Poor investment decisions haunted Nauru’s leaders. They poured money into luxury real estate in Australia and even backed a disastrous play in London. Both flopped.

- By the late 1970s, the dream was fading. The phosphate money was running out, and the investments weren’t paying off.

Failed Attempts to Secure the Future

When you have no more resources, what do you do? Nauru tried everything:

- Leasing territory for dubious purposes.

- Selling passports to foreigners.

- Setting up as a tax haven—at one point, there were 400 offshore banks on the island, holding billions in foreign deposits.

It all sounds desperate, right? Because it was.

From Agriculture to Extinction of Old Ways

With the land ruined, traditional farming was impossible. People who once grew their own food now had to import almost everything. The old ways—gardening, fishing, living off the land—were lost.

The Psychological Impact: A Society in Shock

It’s hard to imagine the shock. One generation lived in paradise. The next, on a moonscape. The sudden loss of wealth, the environmental devastation, the failed dreams—these left scars deeper than the limestone pinnacles.

You might wonder: How do you rebuild when the ground beneath you is literally gone?

By the Numbers: Nauru’s Downward Spiral

| Event | Details |

|---|---|

| Phosphate Mining | 80% of island stripped by 1998 |

| Investment Failures | Real estate and cultural ventures failed after 1970s |

| Offshore Banking | 400 banks by late 1990s, $70 billion (mostly Russian deposits) |

Nauru’s story is a portrait of environmental and societal collapse. Easy money led to reckless choices, and when the music stopped, there was nothing left but stone.

Section 4: Enter the Metal Apples—The Next Economic Miracle or Just Another Gamble?

What Are These Mysterious ‘Metal Apples’?

Ever heard of metal apples? Sounds like something out of a sci-fi novel, right? But these are real. Scientists call them polymetallic nodules. They’re small, lumpy rocks, scattered across the deep Pacific. Not on land—nope. They’re chilling on the ocean floor, 4,000 to 5,000 meters underwater. That’s deeper than most submarines ever go.

Billions of these apples sit on the ocean floor, 4 km underwater.

Here’s the wild part: these nodules grow at a snail’s pace. Actually, slower. We’re talking a millimeter or two every million years. Imagine waiting for your apple tree to grow, but it takes longer than human civilization has existed. That’s the scale we’re dealing with.

Why the Sudden Global Obsession?

So, why does the world suddenly care about these slow-growing lumps? The answer is in your pocket—or maybe parked in your driveway. Phones, electric cars, wind turbines. All these need rare metals: manganese, nickel, cobalt. Guess what? The metal apples are packed with them.

- Batteries for electric vehicles

- Electronics—think smartphones, laptops

- Green tech—solar panels, wind turbines

Demand is skyrocketing. Mining companies and tech giants are eyeing the ocean floor like it’s a new gold rush.

Nauru’s High-Stakes Bet

Now, here’s where Nauru comes in. This tiny island nation, barely a dot on the map, sits near the Clarion Clipperton Zone—a vast, remote stretch of the Pacific. It can’t grow much food. But it’s got a front-row seat to this underwater bonanza. Nauru is backing a company that wants to scoop up these nodules, hoping for the next big payday.

The Lure—and the Dangers—of Deep Sea Mining

But wait. Is it really that simple? Not quite. Deep sea mining is risky. The ocean floor is a fragile, mysterious world. We barely understand it. What happens if we start vacuuming up billions of nodules? Scientists warn of unknown environmental impacts. Some say it could wipe out species we haven’t even discovered yet.

Who Owns the Ocean’s Treasure?

And then there’s the politics. Who gets the profits? Who protects the environment? Countries and international bodies are drawing lines and boxes on ocean maps, staking claims. It’s a global debate—ownership, ecology, and the promise of wealth, all tangled together.

| Fact | Details |

|---|---|

| Number of Nodules | Billions across the Pacific |

| Depth | 4,000–5,000 meters underwater |

| Metals | Manganese, Nickel, Cobalt |

So, is this the next economic miracle for Nauru—or just another high-stakes gamble? The world is watching, but the answers are still buried deep beneath the waves.

Section 5: Law of the Sea or Law of the Jungle? Battling for Control

Who Gets a Piece of the Seabed?

Imagine a patch of ocean floor, thousands of meters down, covered in mysterious metal nodules. Now picture a map—lines and boxes everywhere. Each one drawn by a different country or company, all staking their claim. It’s like a giant game of Risk, but the board is 4,000–5,000 meters underwater. Who actually owns these “metal apples”? That’s the billion-dollar question.

Nauru: The Unexpected Broker

You might think the big players—like the U.S. or China—would control the action. But here’s a twist: tiny Nauru, far from the Clarion Clipperton Zone, is right in the middle of the scramble. Why? Because Nauru has become a broker, linking up with corporations and governments eager to get their hands on the seabed’s riches. It’s a web of interests, all tangled together, and Nauru’s fortunes are tied to the outcome.

The Rules: Whose Are They, Anyway?

- International bodies like the United Nations Convention on the Law of the Sea (UNCLOS) try to set the ground rules.

- Individual nations—especially powerful ones—sometimes threaten to go it alone.

- And then there’s the wild card: whoever grabs first, wins?

It’s not just theory. The U.S., for example, has made moves to fast-track its own mining plans. Remember that Trump-era executive order? It basically said, “We’ll go get those nodules, with or without the world’s permission.” That’s a big deal. When global accords get ignored, the whole system starts to wobble.

Lawlessness on the High Seas?

What happens if everyone ignores the rules? You get chaos. Or, as one observer put it:

If they overplay their hand, then it will be on their watch that lawlessness might come back to the high seas.

It’s not just about money or minerals. It’s about sovereignty, power, and who gets to decide what happens in the deep. The risk? Open season on the ocean floor. No oversight. No accountability. Just a free-for-all.

The Ethical Quagmire

- We barely understand these deep-sea ecosystems.

- What happens if we start ripping up the seabed for profit?

- Is it right to exploit what we can’t even fully study yet?

You can feel the tension. On one side, the promise of new resources. On the other, the fear of destroying something irreplaceable. The ethical lines blur fast when the stakes are this high.

So, as the world draws its boxes and lines across the ocean, the real battle isn’t just for metal. It’s for control, legitimacy, and maybe even the soul of the high seas.

Section 6: Life in the Abyss—What’s Really at Stake for the Deep Ocean?

How Deep Is Deep? A Journey Into the Abyss

Ever wondered how far down the ocean really goes? Imagine standing at the base of the World Trade Center. Now, picture sinking past that, way past, until you reach the pitch-black world where even the Titanic rests—3,800 meters below the surface. But we’re not stopping there. The real action is even deeper, at 4,000 to 5,000 meters. Down here, the water is almost freezing, and the pressure? It’s crushing. Literally.

It’s so quiet, it almost feels like time stands still. Not much moves. Not much, but not nothing.

An Alien World—But Not Empty

- At these depths, you’ll find creatures that look like they belong in a sci-fi movie. Weird fish, strange worms, things with no eyes.

- It’s easy to think nothing could survive here. But that’s a myth.

- “There’s a low abundance of life, but a high diversity.” That means you won’t see swarms of fish, but you will find a surprising variety of species—many of them unique to the deep.

We barely know what’s down here. Scientists are still discovering new species every time they send a submersible. Some of these creatures have never been seen before, and might never be seen again.

What We Don’t Know—And What We Could Lose

Here’s the kicker: we know almost nothing about these deep-sea ecosystems. Every time we dig or scrape the seabed, we risk wiping out entire species before we even realize they exist.

It’s a bit like burning a library before you’ve read a single book.

- Mining could cause irreversible damage.

- Species unknown to science could vanish forever.

- We’re talking about millions of years to make a ‘metal apple’—those precious nodules grow just 1–2 millimeters per million years. And yet, it takes only seconds to destroy the seabed with heavy machinery.

Are We Repeating History—But Underwater?

Think about it. Every resource rush in history—gold, oil, guano—left scars on the planet. What if we’re about to do it again, but this time, in the last truly wild place on Earth?

It’s not just about economics. It’s about what kind of planet you want to leave behind.

The deep ocean isn’t just “rocks.” It’s an alien wonderland, fragile and mostly unexplored. And once it’s gone, it’s gone.

Section 7: Wild Cards from Nauru—How Tiny Nations Can Reshape the World

When Desperation Breeds Oddball Policies

You might not expect a speck of land in the Pacific to shake up the world’s financial systems. But Nauru—yes, that tiny island—did just that. When the phosphate money dried up, Nauru’s leaders scrambled for new ways to keep the lights on. Their solution? Monetize sovereignty.

- Passport sales: Need a new identity? Nauru had a price.

- Offshore tax haven schemes: Minimal oversight, maximum secrecy.

It sounds almost like a plot from a spy movie. But for Nauru, it was survival.

Operation Weasel: The Passport-for-Cash Frenzy

You might wonder, who would buy a Nauruan passport? Turns out, a lot of people. Some were escaping oppressive regimes. Others just wanted a tax break or a fresh start. The market boomed.

Then came Operation Weasel—a global crackdown on fraudulent passports and shady banking. Suddenly, this tiny island was at the center of an international storm.

Big Ripples from a Small Stone

Here’s where things get wild. Nauru, with barely 10,000 residents, started handing out offshore banking licenses like candy. At its peak, there were 400 offshore banks registered on the island.

Like this tiny island at one point was operating 400 offshore banks that eventually attracted $70 billion of Russian money.

That’s right—$70 billion flowed through Nauru, much of it suspected to be laundered cash from Russia. The world’s financial watchdogs took notice. Suddenly, decisions made in a single government office on a Pacific atoll were echoing through Moscow, Beijing, and Washington.

The Butterfly Effect: When Small Means Mighty

Ever heard of the butterfly effect? The idea that a butterfly flapping its wings in one part of the world can set off a tornado somewhere else? Nauru is the butterfly. Its desperate, sometimes bizarre policies sent shockwaves across continents.

- Russian oligarchs found new loopholes.

- Western banks scrambled to tighten regulations.

- China watched, learned, and adapted.

Ignore the small, and you risk toppling the big. That’s the lesson here.

Nauru: A Mirror for Global Greed and Folly

If you look closely, Nauru isn’t just a quirky footnote in financial history. It’s a mirror. The island’s wild experiments with passports and offshore banks reflect a world hungry for shortcuts and loopholes.

Sometimes, the smallest players force the biggest changes. And sometimes, the world’s greed finds its strangest home on a forgotten island in the Pacific.

Conclusion: Lessons Carved by Time and Watermelons—A New Perspective for a Changing World

Small Things, Big Truths

Ever notice how the tiniest details can flip your whole perspective? Think about it: watermelons and metal apples. At first, they seem like random objects. But if you look closer, they’re clues. Clues to how the world works, how fortunes are made and lost, and how the smallest things can reveal the biggest truths.

- Watermelons: A simple fruit, but also a symbol of abundance, scarcity, and the unpredictable swings of value.

- Metal apples: Those shiny nodules on the sea floor—strange, almost cartoonish, but packed with minerals that could power the next tech revolution.

History Echoes in the Deep

You’ve seen how ecological history can be a warning sign. Nauru’s story is more than a quirky footnote. It’s a flashing red light. When a tiny island went from phosphate riches (thanks, bird poop) to environmental disaster, it showed us what can happen when we chase short-term gain without thinking about the long-term cost.

Now, deep-sea mining is on the table. The stakes? Even higher. The ocean floor isn’t just a blank slate—it’s a living, breathing ecosystem. Once you start scooping up those “metal apples,” you can’t just put things back the way they were.

Nauru: A Cautionary Tale

- Resource booms: Fast money, fast decline.

- Busts: Environmental scars that last for generations.

- Lessons: Easy to ignore, until it’s too late.

Nauru’s experience isn’t unique. It’s a mirror for every place that’s ever struck it rich, then paid the price.

Rethinking Value and Protection

Here’s a question for you: How do we decide what’s truly valuable? Is it the quick profit, or the lasting health of our planet? Maybe it’s time to rethink how we use, value, and protect natural wealth. Not just for us, but for everyone who comes next.

Ultimately, I’m trying to figure out if going after all these little metal apples on the sea floor is a great idea or a horrible one.

What’s the Next Nauru?

Let’s be honest—history loves to repeat itself. Will we spot the warning signs this time? Or will we only see the consequences when it’s too late? The next “Nauru” could be anywhere. Maybe it’s already out there, waiting for us to notice.

From fruit prices to planetary stakes, the journey is surprising. But the lesson? It’s right in front of you, if you’re willing to look.

FAQ: Nauru, Deep-Sea Mining, and Resource Curses—Questions You Didn’t Know You Had

Why can’t Nauru grow food anymore?

You might be surprised, but Nauru’s soil is almost gone. Years of phosphate mining stripped away the land’s nutrients. Now, there’s “almost no ability to grow anything on this island.” Imagine living on a place where the earth itself is hollowed out—nothing left to plant, nothing left to harvest. It’s not just tough; it’s nearly impossible.

What exactly are polymetallic nodules and why are they valuable?

Think of these as “metal apples” lying on the deep ocean floor. They’re small, lumpy rocks packed with metals like nickel, cobalt, and manganese. These metals are crucial for batteries and electronics—basically, the stuff powering your phone or electric car. That’s why companies and countries are eyeing them like buried treasure.

Could deep sea mining really save Nauru? Or just doom it again?

It’s tempting to hope for a miracle. But history warns us. Nauru once got rich quick from phosphate, then crashed hard. Deep-sea mining could bring money, sure. But it also risks wrecking fragile ocean ecosystems. Could it be déjà vu? Another boom, another bust? No one really knows yet.

How does international law deal with ocean-floor resources?

The ocean floor isn’t a free-for-all. The United Nations Convention on the Law of the Sea (UNCLOS) sets the rules. Countries need permission from the International Seabed Authority to mine in international waters. It’s a legal maze, with lots of debate about who gets what and how to protect the planet.

Why does Nauru sell passports and what happened with offshore banking?

Desperation breeds strange solutions. When phosphate money dried up, Nauru started selling passports. Anyone—from Russians to alleged terrorists—could buy one for the right price. Then came offshore banking. At one point, Nauru had 400 offshore banks and attracted $70 billion. But with “minimal regulatory oversight,” it became a haven for shady deals. Eventually, global pressure shut it all down.

How can individuals influence these global debates?

You might feel powerless, but your voice matters. You can support organizations pushing for ocean protection. You can ask companies about their supply chains. Even sharing stories like Nauru’s can spark conversations. Small actions, when multiplied, can shift the global tide.

Are there solutions for restoring places like Nauru?

Restoration isn’t easy. Some experts suggest replanting native vegetation or building up soil with compost. Others look to new economies—like renewable energy or sustainable tourism. But scars run deep. Healing takes time, money, and, honestly, a bit of hope.

Nauru’s saga isn’t just about one island. It’s a warning and a question: what happens when you dig too deep, chase quick riches, and forget the future? The answers aren’t simple. But asking the right questions—like you just did—might be the first step toward something better.

TL;DR: Nauru’s incredible journey—from a paradise enriched by bird droppings to environmental ruin and the frontlines of deep-sea mining—offers vital lessons about resource booms, human folly, and the global scramble for new minerals. When tiny nations face big choices, the ripple effects travel much, much further than their shores.