Picture this: my uncle once told me the ultimate measure of wealth was never how much he had in the bank, but whether he could take an afternoon nap without worrying about work emails. Absurd? Maybe. But as the world whirls on with tariffs, AI, and economic curveballs, more of us are realizing that the old formula—get richer, feel better—doesn’t always add up. What if true financial freedom starts not with a spreadsheet, but with a radical reset of your expectations?

1. Why Mindset Beats Millions: Lessons from Grandma and the Mega-Rich

What Does Real Independence Look Like?

You might think financial freedom is about having millions in the bank. But is it? Let’s look at a real-life example: a 92-year-old grandmother-in-law who lived happily on just $1,700 a month from Social Security. No savings. No pension. No backup plan. Yet, she was happier than any billionaire you’ll ever meet.

She had a level of psychological wealth that was unparalleled.

She spent her days in the garden, watching birds, reading library books, and walking. No stress, no restless nights, no endless meetings. She didn’t need more. That’s the secret—independence isn’t about what you have, but what you need.

Billionaires: Rich, But Not Always Free

-

Ever envy billionaires? It’s easy. But many are trapped by their own success.

-

They juggle employees, suppliers, customers, regulators, and public scrutiny.

-

Some wake up at 3 a.m., sweating over emails and obligations.

-

It’s a weird twist: more money, more stress. Less freedom, sometimes.

“If your expectations are growing faster than your net worth, it’s never going to feel like independence.”

The Real Equation: Wanting Less > Having More

Financial freedom isn’t about chasing a finish line that keeps moving. It’s about wanting less than you have. If you can manage your expectations, you can feel rich—no matter your bank balance.

Adam Smith, the famous economist, noticed this 300 years ago. He asked: why do people work so hard, even when their basic needs are met? His answer: People crave attention and admiration, not just survival. Maybe that’s why so many chase more, even when “enough” is right in front of them.

Personal Reflection

Think back. Was there a time you felt wealthiest after quitting a stressful job? Maybe your bank account shrank, but your sense of freedom soared. That’s the mindset shift that matters.

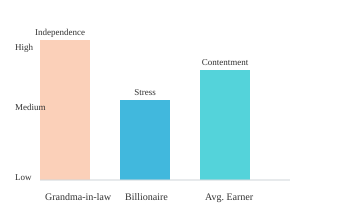

Psychological Wealth: A Comparison

-

Grandmother-in-law: Highest psychological wealth, despite low income.

-

Billionaire: High net worth, but often low independence and happiness.

-

Average income earner: Somewhere in between—depends on mindset.

So, next time you measure wealth, ask yourself: is it your net worth, or your ability to enjoy what you already have?

2. The Status Trap: Why ‘Enough’ Never Feels Like Enough

Is Wealth About Comfort—or Who’s Watching?

You probably think wealth is about what you own. But pause for a second. Is it really? Or is it about who notices what you own?

Most of us chase a bigger house, flashier car, or that next-level vacation. But why? Adam Smith, way back in the 1700s, noticed something odd: people work not just for money, but for attention and admiration. Even when they have enough, they want more—because others are watching.

Evolution Wired Us for Status

Here’s the twist. This isn’t just modern consumerism. Naval Ravikant points out that our craving for status is ancient. Back in the day, status meant survival. If people respected you, you had food, safety, and a shot at passing on your genes.

Now? The stakes are lower, but the urge is the same. That’s why even the ultra-rich keep reaching for more. Not for comfort, but for recognition.

When “More” Stops Being “Better”

-

Lottery winner syndrome: Ever heard of someone who wins big, upgrades everything, and still feels empty? I have a friend who did just that. New house, new car, new everything. But once the neighbors stopped caring, the thrill faded. Fast.

-

Billionaire mansion madness: Harvey Firestone and Henry Ford—two titans of industry—bought homes way bigger than they needed. Not because they loved cleaning extra bathrooms. Just for show. Firestone even admitted,

“It has to be status. There’s no utility to a 40-bedroom house. Zero. There’s a lot of downside in upkeep.”

How Much Money Changes Your Life (and When It Doesn’t)

Let’s get real. The jump from $10,000 to $200,000 a year? Life-changing. You stop worrying about rent, food, and basic needs. But from $200,000 to $500,000? Not as dramatic. And $20 million to $20 billion? Practically zero difference in day-to-day happiness.

|

Income/Net Worth |

Quality of Life Impact |

Real-World Example |

|---|---|---|

|

$10,000/year |

Constant stress, basic needs unmet |

|

|

$200,000/year |

Major life upgrade, security, comfort |

|

|

$500,000/year |

Some improvement, but less dramatic |

|

|

$20 million |

Luxury, but diminishing returns |

Firestone & Ford bought mansions ‘bigger than needed’ |

|

$20 billion |

Almost no added happiness |

Why Even Billionaires Regret the Trap

-

Firestone called his mansion a “burden.”

-

Ford was famously frugal, but still fell for the status game.

So, next time you feel “less than” because someone else has more, remember: even billionaires can’t escape the status trap. And sometimes, they wish they could.

3. How Much is ‘Enough’? Tales from the Monk Billionaire and the Man in the Library

What Does “Enough” Really Look Like?

Ever wonder if you’d be happier with a private jet? Or maybe a mansion with a dozen bathrooms? You’re not alone. Most people chase bigger, shinier things, thinking the next milestone will finally bring contentment. But what if the real answer is a lot simpler—and a lot less expensive?

Meet Chuck Feeney: The Billionaire Who Lived Like a Monk

-

Chuck Feeney started Duty-Free Stores (DFS) and at his peak, was worth about $9 billion.

-

He lived in a one-bedroom apartment, drove a regular car, and always flew coach.

-

For a few years, he did the billionaire thing—private jets, yachts, mansions all over the world.

-

Then he realized: all that stuff didn’t make him happier. So, he gave it all away. Literally. Every last dollar to charity.

What’s wild is, Feeney didn’t do this because he thought it would make him look good. He just didn’t care about what the world said he should want. As he put it:

“I don’t care what the world tells me to like. I’m going to do it on my own terms.” — Chuck Feeney

Warren Buffett: The Billionaire Next Door

-

Warren Buffett could buy, well, anything. But he still lives in the same house he bought at age 27.

-

He prefers bridge games with friends over fancy galas.

-

Despite a net worth north of $100 billion, his lifestyle is surprisingly ordinary.

Buffett’s not chasing status. He’s just doing what makes him happy. It’s almost boring—except it’s not, because it’s so rare.

Chasing the Wrong Dream?

Here’s the kicker: Sometimes, you have to live the dream to realize it’s the wrong one. Feeney did the billionaire lifestyle for a while and found it empty. You might think you need to climb every rung on the wealth ladder, but—honestly? You don’t. Most of us could learn the lesson much sooner.

-

The curve of happiness flattens once your basic needs and a few personal interests are covered.

-

More stuff rarely equals more joy.

Both legendary and “ordinary” folks escape the status trap by setting their own rules. They don’t let the world decide what’s enough.

Notice how both Feeney and Buffett chose simplicity, even with fortunes most of us can’t imagine. The cost of living? Not as important as the cost of chasing someone else’s idea of happiness.

Conclusion: Stop Playing the Game—Or At Least Set Your Own Rules

Let’s be honest. You’re not crazy for wanting more. Most of us have been there—staring at bills, worrying about rent, thinking, “If I just had a bit more, I’d finally relax.” But here’s the twist: sometimes, happiness means wanting less, not more.

It’s easy to think financial independence is a finish line. Something you cross, and then—poof!—life is perfect. But that’s not really how it works. Financial freedom is a decision. Sometimes, it’s as simple as refusing to let status, or what other people think, dictate what matters to you.

Take Warren Buffett or Chuck Feeney. These guys could do anything. What do they choose? Simple pleasures. Birdwatching. Playing bridge. Taking a nap without guilt. They set their own rules. They’re not chasing more just because everyone else is running.

There’s a weird thing about money. When you don’t have enough, it’s all you can think about. The pain in your belly, the bills piling up, the stress of not being able to provide. It’s real. And honestly, when someone rich says, “Money doesn’t buy happiness,” it’s hard to believe them. You might even think, “Let me go figure that out for myself first.”

“Money doesn’t buy happiness—okay, but let me go figure that out for myself first.”

But here’s what happens: the difference between having nothing and having enough is massive. It changes everything. But after a certain point, more money doesn’t really add much. The jump from $10,000 to $200,000 a year? Life-changing. From $200,000 to $500,000? Not as dramatic. From $500,000 to $20 million? Even less. And from $20 million to $20 billion? Zero. In fact, it can even become a burden—more pressure, more expectations, more people telling you what you should do.

So, what if you stopped playing the game? Or at least, started playing by your own rules. Imagine if you could automate your happiness, like a self-driving car picking the best route. Would you trust it? Or would you want to keep your hands on the wheel, making your own turns, even if you hit a little traffic?

Finding contentment is about knowing when “more” becomes meaningless. Social pressure and our own instincts can be powerful, but they’re not destiny. Think back—when were you most at peace? Odds are, it had nothing to do with your bank balance.

Maybe it’s time to disconnect from the rat race. Set your own yardstick for abundance. You might just discover that psychological wealth costs a lot less than you think.

|

Key Takeaway |

What It Means for You |

|---|---|

|

Wanting more is normal |

But happiness might mean wanting less |

|

Financial independence is a choice |

Don’t let others define your success |

|

Set your own rules |

Do what makes you happy, not what impresses others |

|

Automate happiness? |

Would you trust a shortcut, or do you want to choose your own path? |

TL;DR: Financial independence isn’t just about amassing wealth; it’s about curbing your wants, understanding your psychological triggers, and defining freedom for yourself. Status will keep moving the target—so maybe the real trick is refusing to play that game.