Let me start with a confession: For years, I thought understanding money was just about tracking expenses and hunting for the best credit card deals. Then, mid-pandemic, a conversation with a friend changed my view entirely. She blurted, “My partner and I bicker more about grocery budgets than anything else!” Suddenly, it hit me—personal finance isn’t just math, it’s messy, emotional, and sometimes a little ridiculous. So, if you’ve ever stress-bought coffee or avoided talking numbers with your partner, this one’s for you. Let’s go beyond the calculators—together.

1. The Four Hidden Money Types: Which One Are You?

When you think about personal finance, what comes to mind? Maybe it’s budgeting, saving, or investing. But have you ever considered that your entire approach to money—your spending, saving, and even your arguments about finances—might be shaped by an underlying money personality? Research shows that most people fall into one of four hidden money types: Avoiders, Optimizers, Dreamers, or Worriers (0.19-0.21). Understanding which type you are is a powerful first step toward financial literacy and financial well-being.

Meet the Four Money Types

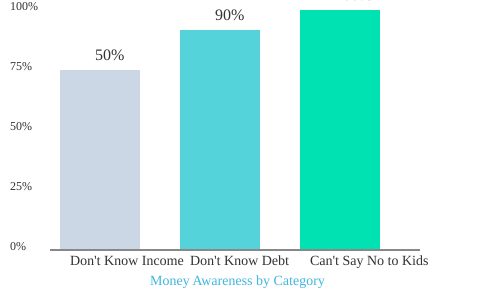

- Avoiders: If you hate talking about money, you might be an Avoider (0.23-0.25). Avoiders often dodge financial conversations and, as a result, may have little idea about their income or debt. In fact, 50% of people don’t know their household income, and 90% of those in debt don’t know how much they owe (0.31-0.35). It’s not just forgetfulness—it’s a coping mechanism. Ignoring bills and statements can feel easier than facing uncomfortable truths (4.10-4.15).

- Optimizers: These are the spreadsheet lovers, always looking for the best deal and maximizing every dollar (0.43-0.48). Optimizers can help a household reach financial goals, but sometimes take things too far—like optimizing dinner plans or micromanaging every expense. Their attention to detail is a strength, but it can also lead to stress and friction in relationships.

- Dreamers: Dreamers believe that financial success is just one big break away (0.50-0.53). They’re drawn to bold investments and sometimes risky ventures—think crypto coins or “can’t-miss” opportunities (0.53-0.56). While optimism is great, Dreamers can fall for scams or overlook practical steps toward financial stability.

- Worriers: If you constantly ask, “Will we have enough?” you might be a Worrier (0.59-1.00). This type often learned their habits from parents who repeated phrases like “money doesn’t grow on trees” (1.03-1.05). While caution is wise, excessive worry can lead to penny-pinching and anxiety, sometimes at the expense of enjoying life.

How Money Types Shape Your Real Life

Your money type isn’t just a label—it influences everything from relationship arguments to shopping splurges. For example, if you’re an Avoider, you might panic over a $3 coffee but impulse-buy the latest gadget. Optimizers might debate for hours over which streaming service is the best value, while Dreamers may skip the budget talk entirely, hoping a windfall is just around the corner. Worriers, meanwhile, might obsess over every bill, turning minor purchases into major stressors.

These patterns aren’t just quirks—they can have real consequences. Studies indicate that financial stress is linked to sleep problems, relationship strain, and even decreased work productivity. In couples, mismatched money types often lead to recurring arguments and misunderstandings (3.31-3.38). One surprising insight: 100% of people in credit card debt struggle to say no to their children (3.51-3.56). Boundaries around spending, especially with family, are a common challenge.

50% of the people I talk to do not know their household income. 90% of the people I talk to who are in debt do not know how much debt they’re in, and 100% in credit card debt also have trouble saying no to their children.

Why Recognizing Your Money Type Matters

Recognizing your money type is the first step toward financial mindfulness and better financial literacy. When you know your strengths and blind spots, you can make more intentional choices. For example, Optimizers can learn to relax their grip, Dreamers can set realistic goals, Avoiders can face their finances with less fear, and Worriers can practice gratitude and trust. Financial therapy and mindfulness practices are growing in popularity because they help people address the emotional side of money—not just the numbers.

Research highlights that improving financial literacy isn’t just about knowledge—it’s about changing behaviors and mindsets. As you explore your own money type, remember: financial well-being is about more than dollars and cents. It’s about understanding yourself, your habits, and how you relate to those around you.

2. When Love and Money Collide: Relationship Dynamics and Dollars

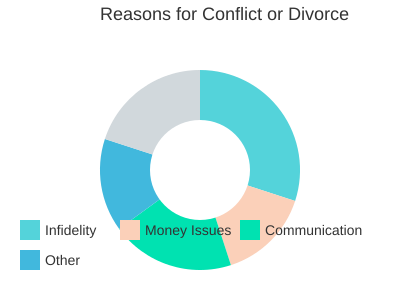

Money isn’t just about numbers—it’s about emotions, power, and sometimes, heartbreak. If you’ve ever wondered why financial stress can feel so overwhelming in your relationship, you’re not alone. According to a seasoned divorce lawyer (2.57-3.12), “There’s two things which cause people to end up in [the divorce lawyer’s] office… cheating and money problems in the relationship.” That’s right: after infidelity, money issues are the leading cause of breakups and divorce. This isn’t just anecdotal—research shows that financial stress is a major source of tension for couples, deeply affecting both financial well-being and mental health.

Why Money Fights Are So Common

It’s easy to assume that money arguments are about the bills or who pays for dinner. But dig a little deeper, and you’ll find that these conflicts often mask deeper emotional needs. In fact, many couples don’t even know the basics about their own finances. In conversations with hundreds of couples, it was revealed that:

- 50% do not know their household income (3.38-4.02).

- 90% of those in debt don’t know the total amount owed.

- 100% of people in credit card debt struggle to say no to their children.

These numbers are shocking, but they highlight a common pattern: financial avoidance. Most people simply check their bank account balance and hope for the best, rarely confronting the reality of their financial situation. This avoidance can lead to chronic financial stress, which, as studies indicate, is closely tied to anxiety, sleep problems, and relationship strain.

Changing Gender Roles and Power Dynamics

Traditional ideas about who should provide or save are rapidly evolving. More women are now the primary earners in their households, which is shifting the balance of power and expectations within relationships. For example, in one case, a woman earning $200,000 per month was dating a man making just a few thousand (8.57-9.36). She grew up learning about investing from a young age, while he had little financial education. Despite her success, she wanted him to pay for dinner sometimes, craving the feeling of being cared for. Yet, when he offered, she’d insist he save for retirement instead. This “dinner pay dance” might seem irrational from the outside, but it’s a real example of how emotional needs and financial habits collide.

What’s fascinating is that these dances—however odd they seem—aren’t about the money itself. They’re about feeling secure, valued, or equal. As more women out-earn their partners, couples are forced to renegotiate what “providing” looks like. According to recent data, 80% of women still expect their romantic partner to earn more, even as more women become primary earners. This gap between expectation and reality can create tension, but it also opens the door for new, healthier conversations about personal finance and partnership.

Secrets, Trust, and Emotional Safety

Another common issue is secrecy—hidden bank accounts, secret spending, or simply not talking about money at all. Sometimes, these secrets are cultural carryovers, meant to provide security. Other times, they breed distrust and resentment. The key to true financial well-being isn’t just about having more money; it’s about being able to discuss your quirkiest money habits openly, without judgment.

Financial Well-being Means Facing the Weird Stuff

Everyone has irrational money habits—yes, even you. Maybe you argue over credit card points, or you have a monthly “dance” about who pays for what. The healthiest couples aren’t the ones who never fight about money; they’re the ones who talk about it, acknowledge their quirks, and build a shared vision for their financial future. As research shows, financial and personal well-being are deeply interconnected. When you avoid these conversations, you risk letting financial stress erode your mental health and your relationship.

There’s two things which cause people to end up in [the divorce lawyer’s] office… cheating and money problems in the relationship.

When love and money collide, it’s not just about dollars and cents. It’s about trust, communication, and building a vision for your life together—quirks and all.

3. Mind Over Money: The Promise of Financial Therapy and Mindfulness

When you think about financial well-being, you might picture spreadsheets, budgets, and maybe a growing savings account. But what if the real secret to feeling secure with money isn’t just about the numbers? Increasingly, experts and research are pointing to something deeper: your mindset. This is where Financial Therapy and Financial Mindfulness come in—two emerging trends that are transforming how people approach money, stress, and even relationships.

Why Financial Therapy Is Gaining Ground

Let’s start with a simple truth: money stress isn’t just about how much you have. In fact, as highlighted in the transcript (6.55-7.00), “

The way you feel about money is highly uncorrelated to the amount in your bank account.

” You might assume that millionaires sleep soundly at night, but many still worry about finances. The anxiety doesn’t magically disappear when your balance grows. This is why Financial Therapy is gaining traction—it addresses the emotional roots of money stress, not just the math.

Financial therapy is a growing field focused on tackling emotional spending, financial anxiety, and the psychological patterns that shape your relationship with money. According to research, this approach is entering mainstream personal finance discussions because people are realizing that understanding your numbers is only half the battle (6.53-7.40).

Money Anxiety: It’s Not About the Balance

It’s easy to think, “If I just had $50,000 more, or $500,000 more, or even $5 million more, I’d finally feel secure.” But as the transcript reveals, even those who have reached these milestones still worry about money (7.03-7.15). This means that financial insecurity is often a mindset issue, not a math problem. You need to master both your financial literacy and your money psychology.

- Financial Therapy helps you uncover the emotional triggers behind your spending and saving habits.

- Financial Mindfulness encourages you to pause and reflect before making financial decisions, breaking automatic patterns like doomscrolling Amazon deals.

Financial Mindfulness: A New Approach to Everyday Money Decisions

So, what does Financial Mindfulness look like in practice? Imagine treating your next budget check-in like a spa day instead of a chore. Take a deep breath, light a candle, and give yourself the space to reflect on your spending and saving. This small shift can make a big difference.

Here’s a personal anecdote: I tried “mindful spending” for a week. Each time I reached for my phone to make an impulse purchase, I paused, took a breath, and asked myself if the item truly added value to my life. The result? I saved money and noticed my mood improved. The act of slowing down and being intentional with money decisions led to less stress and more satisfaction.

Financial Therapy, Mindfulness, and Your Relationships

It’s not just about your bank account or your mood—Financial Therapy and Financial Mindfulness can also bolster your relationships. Money is a common source of tension in couples and families. By addressing the emotional side of money, you can communicate more openly and reduce conflict.

Research shows that mental health and financial health are closely linked, regardless of net worth. Practicing financial mindfulness can lead to better financial outcomes and a more positive psychological state. In other words, the benefits go far beyond your wallet.

| Practice | Key Benefit |

|---|---|

| Financial Mindfulness | Better financial outcomes and improved psychological well-being |

| Financial Therapy | Addresses emotional roots of money stress, enhances financial well-being |

| Mental Health Focus | Financial health and mental health are closely linked, regardless of net worth |

As you can see, the numbers tell only part of the story. The real promise of Financial Therapy and Financial Mindfulness is helping you feel better about your money—no matter what your account balance says.

4. The Myth of Homeownership: Renting, Investing, and the Shocking Math

For generations, the idea that you must buy a house to achieve financial success has been deeply embedded in our culture. If you’ve ever heard, “Renting is just throwing money away,” you’re not alone. But let’s pause and look at the numbers—because sometimes, the math tells a very different story (12.44-13.19).

Challenging Tradition: Why Renting Isn’t Always a Waste

It’s easy to feel pressure from family, friends, and society to buy a home as soon as possible. The message is everywhere: Homeownership equals stability, success, and smart financial planning. But is that always true? Not necessarily. In fact, the belief that renting is a waste can cloud your judgment and keep you from seeing real opportunities for financial growth.

Let’s be honest—many people never actually run the numbers. They just assume buying is better because that’s what they’ve always heard. But when you compare the costs of renting versus buying, and factor in what you could do by investing the difference, the results can be surprising. Sometimes, renting and investing the money you save can actually lead to better financial outcomes than buying a home outright.

I have rented for the last 20 years by choice and made more money renting and investing the difference than I would have by buying a house.

The Power of Investing the Difference

Here’s the thing: When you rent, you may have extra cash that would otherwise go toward a down payment, property taxes, maintenance, and other homeownership costs. If you invest that money wisely, especially using new personal finance trends like mobile payment apps and advanced financial management tools, you can potentially grow your wealth faster than if it were tied up in a house.

Of course, this isn’t a one-size-fits-all answer. Market trends, interest rates, and your personal situation all play a role. But research shows that, in many cases, renting and investing the difference can outperform buying—especially over the long term. This is financial heresy to some, but it’s a reality worth considering if you want to maximize your financial planning and overall well-being.

Societal Messages vs. Hard Data

It’s fascinating how much our big money decisions are shaped by what we’ve been told, rather than by hard data. The idea that you must buy a house is so strong that even suggesting otherwise can spark strong reactions. In fact, when this topic comes up, people often “go berserk,” as seen in the comments and feedback (12.59-13.19). But if you want to achieve the best possible financial outcomes, you need to look beyond tradition and focus on what the numbers actually say.

Know Your Four Numbers Before Making Big Money Moves

Before you make any major financial decision—whether it’s buying a home, renting, or investing—it’s crucial to know your numbers. Here are four you should always have on hand:

- Your monthly housing costs (rent or mortgage, plus taxes and insurance)

- The potential return on investments if you don’t buy

- Your long-term financial goals and timeline

- Your emergency fund and overall financial cushion

Understanding these numbers can help you make more informed choices that align with your personal values and financial literacy goals.

Are You Taking Action or Just Going with the Flow?

Here’s an interesting sidebar: Over 53% of listeners had not subscribed to the podcast—proof that many people simply go with the flow rather than taking deliberate action. The same goes for homeownership. Are you buying a house because you’ve run the numbers and it makes sense for you, or just because it’s what everyone expects?

| Statistic | Insight |

|---|---|

| 53%+ of listeners not subscribed | Many people follow the crowd instead of making intentional choices |

| Renting & investing the difference | Can outperform buying, depending on market trends and financial planning |

As new personal finance trends continue to emerge, like mobile payment apps and advanced financial management tools, you have more options than ever to manage your money wisely. The key is to approach your decisions with curiosity, skepticism, and a willingness to challenge old assumptions. That’s how you build true financial literacy and set yourself up for long-term success.

5. Technology and the New Age of Personal Finance

You live in a world where your phone can do almost anything—order dinner, hail a ride, and now, manage your entire financial life. The rise of Financial Technology (or “fintech”) has brought about a new era in personal finance trends, making it easier than ever to take control of your money. But with all this convenience, there’s a lot more to the story than just numbers on a screen.

Personal Finance Apps: Your Pocket-Sized Financial Manager

Think about the last time you checked your bank balance. Was it at a branch, or did you just tap an app? Today, personal finance apps have transformed how you budget, invest, and plan for retirement. With a few swipes, you can set up a savings goal, track your spending, or even start investing with just a dollar. These apps are not just about convenience—they’re about empowerment. Research shows that automation and reminders built into these tools can drive positive financial behavior and boost financial literacy.

- Budgeting apps categorize your expenses automatically.

- Micro-investing platforms let you invest spare change from daily purchases.

- Robo-advisors offer personalized investment advice, often for a fraction of the cost of traditional advisors.

Millions now use these data-driven tools, and the trend is only growing. As one expert put it,

New trends in personal finance include mobile payment apps and advanced financial management tools.

Social Media: A Double-Edged Sword for Financial Literacy

Social media is everywhere, and it’s changing how people talk about money. On one hand, you can find smart tips, inspiring debt-free journeys, and even viral “no spend challenges” (which, yes, sometimes actually work—just ask anyone who’s tried one after a well-timed app notification). On the other hand, myths and misinformation spread just as quickly. It’s easy to fall for a “get rich quick” scheme or outdated advice. The challenge? Knowing which voices to trust.

Financial Technology and Underserved Groups: Closing Historic Gaps

It’s important to remember that not everyone has always had equal access to financial tools. In the U.S., for example, it wasn’t long ago that many women couldn’t open their own bank accounts—just two generations back, as noted in the transcript (5.34-5.40). This history has led to a culture where some women, especially older generations, keep a little money aside “just in case”—a practice rooted in real concerns about financial independence and safety (5.27-5.59).

Now, financial technology is helping to close these gaps. Mobile payment and financial planning apps are opening doors for previously underserved groups, making it easier for everyone to manage their finances independently. Access to learning and literacy tools is more widespread, and financial literacy initiatives are gaining traction, helping to build confidence and security for all.

Financial Management Meets Mental Health: The Rise of Financial Therapy

Here’s something you might not expect: the emotional side of money is getting more attention than ever. Financial stress is a major source of anxiety, linked to sleep issues, relationship strain, and even decreased work productivity. That’s where financial therapy comes in—a growing field that blends traditional therapy with money management. Imagine getting therapy from a chatbot or AI advisor. It sounds futuristic, but the technology is already here, raising new questions about privacy, trust, and the human touch.

Studies indicate that practicing financial mindfulness—being aware and intentional with your money—can lead to better outcomes and improved psychological well-being. Financial technology plays a crucial role here, too, providing reminders, goal-setting tools, and even guided exercises to help you stay on track.

The Bottom Line: Technology as Both Tool and Stressor

While fintech has made financial management more accessible, it’s not without its downsides. The constant stream of notifications, the pressure to “optimize” every dollar, and the temptation of comparison on social media can all add new layers of stress. Still, the benefits—greater control, improved literacy, and the ability to close historic gaps—are hard to ignore. The key is using technology mindfully, as a tool for empowerment rather than a source of anxiety.

6. Building Your Personal Financial Well-being Plan

Financial well-being isn’t about chasing perfection or obsessing over spreadsheets. It’s about building a plan that fits your real life—one that blends practical financial management with a healthy mindset. If you want to move beyond just “getting by” and start feeling confident about your money, it’s time to look at both the numbers and your relationship with them.

Get to Know Your Numbers: The Foundation of Financial Literacy

“You’ve got to know your numbers…and master your money psychology.” This advice, echoed in the transcript (7.21-7.27), is a cornerstone of financial well-being. Start by tracking your income, debts, and investments honestly. Don’t just guess—write it down or use a financial management app. This is the language of personal finance, and learning it is essential for anyone who wants to take control of their financial future.

Financial literacy initiatives are everywhere these days, from government resources to online courses. Take advantage of these tools to build your knowledge. Research shows that understanding the basics—like budgeting, saving, and investing—can dramatically reduce financial stress and boost your confidence.

Make Financial Check-ins a Habit

Personal finance isn’t a one-time project; it’s an ongoing process. Set aside time each week (or at least monthly) for a financial check-in. This could be a solo review of your accounts or a conversation with your partner. Studies indicate that people who do regular check-ins report much higher financial confidence and lower stress.

- Review your spending and saving patterns.

- Talk openly about any financial worries or goals.

- Adjust your plan as life changes—flexibility is key.

If you’re in a relationship, these check-ins are even more important. Money is one of the top sources of conflict for couples, so making space for honest conversations can strengthen your partnership and your finances.

Let Go of Perfection: Progress Over Spreadsheets

It’s easy to get overwhelmed by the idea of perfect budgeting or flawless financial management. But real financial well-being comes from progress, not perfection. If you miss a week or overspend, don’t beat yourself up. Instead, focus on what you can learn and how you can adjust moving forward.

Combining tracking tools with self-compassion is powerful. Remember, your worth isn’t measured by your net worth or your ability to stick to a budget every month.

Talk About Your Money ‘Irrationality’

Everyone has quirks when it comes to money—maybe you’re a saver who splurges under stress, or a spender who feels guilty after every purchase. Share these tendencies openly, especially with those closest to you. The transcript (7.27-7.39) highlights the importance of changing the way you talk about and behave with money, so you can ultimately change the way you feel about it.

Financial therapy is a growing field for a reason: money is emotional. If you find that financial anxiety is overwhelming, don’t hesitate to seek professional help. There’s no shame in needing support to manage the psychological side of money.

Blend Classic Budgeting with Financial Mindfulness

Traditional budgeting is useful, but it’s even more effective when paired with financial mindfulness. This means being aware of your spending habits and the emotions that drive them. Research shows that practicing financial mindfulness can lead to better outcomes and more positive psychological well-being.

- Pause before making purchases—ask yourself why you want to buy.

- Reflect on how spending aligns with your values and goals.

- Celebrate small wins, like saving a little extra or resisting an impulse buy.

Reframe What a ‘Rich Life’ Means to You

Ultimately, financial well-being is about more than numbers. It’s about meaning, security, and peace of mind. As you build your plan, focus on what matters most to you—not just hitting financial targets, but creating a life that feels rich in every sense.

7. FAQ: Unlocking Everyday Money Clarity

When it comes to financial well-being, it’s easy to feel overwhelmed by numbers, advice, and the pressure to “get it right.” But most people share the same questions and concerns, no matter their income or relationship status. Let’s break down some of the most common questions, drawing from the insights of financial expert Ramit Sethi and current research on financial literacy and therapy.

Do I really need a budget if I know what I make and spend?

It’s tempting to think that simply knowing your income and expenses is enough. However, research shows that financial clarity comes from more than mental math. Sethi’s “Conscious Spending Plan” isn’t about strict budgets or tracking every coffee purchase—it’s about knowing your fixed costs, savings, investments, and guilt-free spending. This approach helps you make intentional choices and avoid the stress of financial uncertainty. Even if you’re not a spreadsheet lover, setting up a simple plan (and automating savings and investments) can boost your financial literacy and peace of mind.

Is financial therapy only for people in crisis, or is it for everyone?

Financial therapy isn’t just for people facing bankruptcy or major debt. The field is growing rapidly because money is emotional for everyone. Studies indicate that financial stress can lead to sleep problems, relationship strain, and even decreased work productivity. Financial therapy helps you understand your money beliefs, inherited scripts, and emotional triggers—whether you’re an “Avoider,” “Optimizer,” “Dreamer,” or “Worrier.” It’s about building a healthier relationship with money, not just fixing problems.

How do I bring up tricky money topics with my partner?

Money conversations can feel awkward, especially if you grew up in a household where finances were a taboo subject. Sethi recommends starting with curiosity and openness, not blame. Schedule regular money meetings, use a shared Google Doc, and focus on your shared vision for a “rich life.” Remember, the real issue in most relationships isn’t overspending—it’s a lack of communication. Be transparent about your numbers, your goals, and your fears. Over time, these conversations become easier and more productive.

What if I mess up my money plan? Is it possible to recover?

Absolutely. Everyone makes mistakes—whether it’s overspending, missing a savings goal, or falling for a get-rich-quick scheme. The key is to approach setbacks with a growth mindset. Research on financial well-being shows that resilience and adaptability are more important than perfection. Review what happened, adjust your plan, and keep moving forward. As Sethi says, “There’s no single right answer.” What matters is that you keep learning and stay engaged.

Renting vs. owning: What factors should I consider for my situation?

The old advice that “renting is throwing money away” simply doesn’t hold up in every case. Sethi points out that in many cities, renting and investing the difference can be smarter than buying—especially when you factor in “phantom costs” like maintenance and taxes. Run the numbers for your own situation, and don’t let inherited narratives dictate your choices. Financial literacy means questioning assumptions and making decisions based on your actual goals and lifestyle.

Best resources to improve financial literacy quickly

Improving your financial literacy doesn’t have to be overwhelming. Start with trusted books like Sethi’s I Will Teach You To Be Rich, explore free government resources, or use reputable financial technology tools from companies like Vanguard, Fidelity, or Schwab. Podcasts, online courses, and community workshops can also help you build confidence and knowledge. The key is to take small, consistent steps—financial well-being is a journey, not a destination.

In the end, unlocking everyday money clarity is about more than numbers. It’s about understanding your emotions, communicating openly, and making choices that align with your values. Whether you’re navigating relationship dynamics, considering therapy, or just trying to spend guilt-free, remember: financial literacy and well-being are lifelong skills. Stay curious, stay honest, and keep moving forward—your “rich life” is built one conversation at a time.

TL;DR: Money is rarely just about numbers. By understanding your money type, embracing financial therapy, and prioritizing open conversations and mindfulness, you can transform financial stress into financial well-being—for yourself and your relationships.

A big shoutout to The Diary Of A CEO for the thought-provoking content! Be sure to check it out here: https://youtu.be/pz6jhMPA-2w?si=sxZE3_DLCPA5ZcZv.