Let me share a little secret: growing up, I was convinced success had a formula—good grades, big job, maybe a corner office with a view. Turns out, the view didn’t come with the wealth I imagined. I started life with one script, only to later watch friends play entirely different money games—ones nobody taught us about in school. So what are we missing? Here’s an unfiltered look at the unspoken rules and real skills that move you from surviving to thriving, even if you never buy a house or inherit a dime.

Mythbusting: The Rent vs. Own Trap (and Other Money Myths)

If you’ve ever felt pressured to buy a home because “renting is just throwing money away,” you’re not alone. The idea that you can’t build wealth if you rent is one of the most persistent money myths out there (0.02-0.04). But is it really true? Let’s pull back the curtain on this and other common beliefs that might be holding you back from real financial progress.

Debunking the Rent vs. Own Wealth Myth

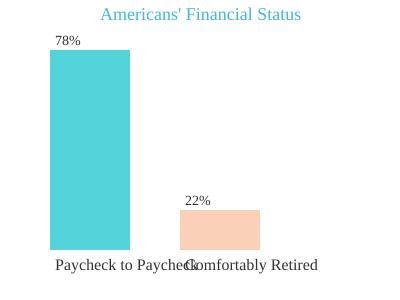

For decades, real estate has been sold as the ultimate path to building wealth. The logic goes: buy a house, watch its value rise, and you’ll be set for life. But research shows that a large majority of Americans are not actually building wealth, even though homeownership rates remain high. In fact, 78% of Americans live paycheck to paycheck (data). That’s a staggering number, and it includes plenty of homeowners.

Why is this happening? The answer is more complex than “renters can’t build wealth.” Many people buy homes they can’t afford, stretching their budgets to the breaking point just to keep up appearances (0.41-0.45). The pressure to look successful—owning a house, driving a nice car, taking lavish vacations—often leads to overspending and financial stress. As Jaspreet Singh puts it,

“The key thing that keeps so many people poor…is they’re scared to look broke.”

Why High Income Doesn’t Guarantee Wealth

Another widespread myth is that a high salary automatically leads to financial security. But studies indicate that income alone doesn’t guarantee wealth. Without solid financial education and good habits, it’s easy to fall into the trap of lifestyle inflation—spending more as you earn more, without actually saving or investing for the future.

Think about it: if you make $200,000 a year but spend $210,000, you’re still in the red. The same social pressures that push people to buy homes they can’t afford also encourage overspending in other areas. The result? Even high earners can find themselves living paycheck to paycheck, with little to show for years of hard work.

Myth: You Need Millions to Start Building Assets

It’s easy to believe that you need a huge windfall or a massive salary to begin building wealth. But that’s just not true (0.06-0.09). Small, consistent steps—like saving a portion of your income, investing in low-cost index funds, or starting a side hustle—can add up over time. The real key is starting early and being consistent, not waiting until you have “enough” to make a big move.

Jaspreet Singh emphasizes that there are ways to build wealth that outperform real estate, stocks, or even cryptocurrency (0.09-0.16). The most important investment you can make is in your own financial education and discipline. Learning how money works, and how to make it work for you, is the foundation of lasting wealth.

Parental Pressure and the Myth of “Safe” Careers

Many of us grew up hearing that the only way to succeed was to become a doctor, lawyer, or engineer (0.36-0.38). Jaspreet Singh shares his own experience with parental expectations, where the path to financial security seemed to run through a handful of “safe” careers. But the world has changed. Today, there are countless ways to earn, invest, and thrive—many of which don’t require a specific degree or title.

Clinging to old ideas about what success looks like can actually limit your potential. What matters most is not the job title, but your ability to manage money wisely, adapt to new opportunities, and keep learning.

Social Pressure and Financial Posturing

It’s hard to ignore the pressure to “keep up with the Joneses.” Whether it’s a new car, designer clothes, or exotic vacations, the urge to appear successful can lead to dangerous financial posturing. Research shows that conformity to social norms often leads to financial insecurity, as people spend beyond their means to fit in.

This cycle is tough to break. But recognizing it is the first step. Ask yourself: are you making financial decisions based on what’s best for you, or what you think others expect?

By the Numbers: The Reality of Financial Insecurity

Let’s look at the numbers. According to recent data, 78% of Americans live paycheck to paycheck, and it’s estimated that you need around $1.8 million to retire comfortably. Yet, most people are far from reaching that goal. The gap between perception and reality is wide—and it’s fueled by persistent money myths and a lack of honest financial education.

This chart makes it clear: the majority are struggling, regardless of whether they rent or own. The lesson? Don’t let outdated money myths or social pressure dictate your financial choices. Focus on education, discipline, and what works for your unique situation.

What School Skipped: The Wealth Curriculum That Never Was

Think back to your school days. You probably remember being told to study hard, get good grades, and land a solid job. Maybe you even recall those career day pamphlets—doctor always listed first, followed by lawyer, engineer, and a few other “safe” picks. But did anyone ever sit you down and explain the difference between an asset and a liability? Or show you how to build true assets, invest wisely, or create passive income streams? For most people, the answer is a resounding no.

Everyone Uses Money, Yet Most Don’t Understand It

It’s a strange paradox. Money is part of your daily life—whether you’re buying groceries, paying rent, or saving for a vacation (see transcript 2:12-2:18). Yet, as research shows, financial education is largely absent from formal schooling. You use money every day, but you’re rarely taught how it actually works. The result? Most people are left to figure out wealth building lessons on their own, often after making costly mistakes.

No Lessons on Assets, Liabilities, or Investing

In most education systems, the curriculum focuses on academic achievement and job readiness. You’re taught to memorize facts, write essays, and pass exams. But when it comes to understanding assets, liabilities, or investing, there’s a glaring gap. The difference between something that puts money in your pocket (an asset) and something that takes money out (a liability) is rarely explained in class. And if you’ve never learned about passive income strategies or financial risk management, you’re not alone (transcript 1:03-1:05).

Consequences: Higher Taxes and Tight Budgets for the Uninformed

So, what happens when you’re not equipped with financial education? The consequences are real and often harsh. As the transcript points out, “you’re the one that’s going to be paying the highest taxes, you’re the one that’s going to be struggling to pay your bills” (2:41-2:46). Without basic wealth building lessons, you might find yourself living paycheck to paycheck—just like the 78% of Americans who do the same (0:45-0:48). You might buy a house you can’t afford, rack up credit card debt, or miss out on opportunities to invest and grow your wealth.

Why the Wealthiest Play by Different Rules

Here’s the kicker: the wealthiest individuals aren’t just working harder at their jobs. They’re playing by a different set of financial rules. As one quote from the transcript puts it,

“They don’t get there by working a job and getting a raise…they understand how money works.”

(3:31-3:34)

This understanding isn’t about luck or privilege alone. Studies indicate that financial literacy is a stronger predictor of wealth than even degree attainment. In other words, knowing how to make money work for you—through true assets, investments, and passive income strategies—matters more than just having a diploma on the wall.

Personal Reflection: The Realization After Years of Study

Maybe you can relate to this: you did everything right. You studied hard, went to college, maybe even pursued graduate school. Yet, after all those years, you realized you never really learned how to manage money, build wealth, or invest for the future (3:45-4:05). It’s a common story, and it highlights the elephant in the classroom—essential wealth-building concepts are left out of formal education, leaving you to fill in the gaps later in life.

Humorous Tangent: Career Day Memories

Let’s not forget those career day pamphlets. Remember how “doctor” was always listed first, as if that was the only path to financial security? The message was clear: get a good job, and everything else will fall into place. But as you’ve probably discovered, a high salary doesn’t automatically translate into wealth—especially if you’re never taught how to manage, invest, and grow your money.

Table: The Missing Wealth Curriculum in Schools

| Financial Topic | Typically Taught in School? | Real-World Impact |

|---|---|---|

| Assets vs. Liabilities | No | Many buy liabilities, thinking they’re assets |

| Investing Basics | No | Missed opportunities for wealth growth |

| Passive Income Strategies | No | Reliance on single income source; less financial security |

| Financial Risk Management | No | Greater vulnerability to debt and emergencies |

| Tax Optimization | No | Higher taxes paid over lifetime |

The Contrast: What’s Taught vs. What’s Needed

Ultimately, the traditional school-to-job pipeline teaches you to “get a good job.” But what you really need are the skills to grow assets, manage risk, and build wealth over time. The lack of financial education in schools isn’t just an oversight—it’s a missed opportunity that affects every aspect of your financial life. If you’ve ever wondered why some people seem to get ahead while others struggle, remember: it’s not just about working harder. It’s about understanding how money works, and making it work for you.

Learning by Doing: Failing, Finding the Game, and Picking Yourself Up

When you think about starting a business, it’s easy to imagine big wins and overnight success. But the reality is often much less glamorous—and far more instructive. If you look behind the curtain, you’ll see that the earliest entrepreneurship lessons usually come from humble beginnings, failed side gigs, and a willingness to try, fail, and try again.

Early Side Hustles: Drumming at Weddings and Teen Parties

Let’s rewind to grade school (8.48-8.51). Picture yourself as a kid, not yet old enough to drive, but already hustling for your first dollar. For some, that might mean mowing lawns or babysitting. For others, it’s something a bit more unique—like playing the toll, a Punjabi drum, at Indian weddings (8.51-8.58). Even if your parents aren’t thrilled (anything not math or science was frowned upon, after all), you sneak out to play because you love it and, honestly, because you’re earning $50 per wedding as a middle schooler (9.11-9.14).

That first taste of making your own money is powerful. It’s not about the amount—it’s about the independence. You realize, as you count your cash after a long night, that you don’t need a license or a degree to make money.

“I don’t need a license or degree to make money.”

First Business Attempts: Meager Returns, Major Lessons

Fast forward to high school. A local DJ notices you know a lot of kids and suggests hosting a teen party (9.20-9.29). You put in the work: organizing, promoting, handling logistics. The party is a hit—at least in terms of turnout. But when it’s time to count profits, you’re left with just four single dollar bills (9.48-9.54). After splitting the $4, you each walk away with $2 (9.54-9.57).

It’s a classic moment in entrepreneurship: the effort far outweighs the financial reward. Yet, you’re not discouraged. In fact, you’re energized. The experience itself is fun, and it plants a seed. You start to see that the real value is in what you learn by doing, not just what you earn.

Classroom Theory vs. Real-World Experience

Research shows that hands-on experience is a more potent teacher than theoretical instruction for entrepreneurship. No textbook can replicate the feeling of putting yourself out there, risking failure, and figuring things out as you go. Those $2 profits? They’re worth more than a hundred hours of classroom lectures because they come with real lessons about effort, risk, and reward.

Breaking Away from the Prescribed Path

For many, the pressure to follow a traditional career path is intense. Maybe you’re expected to become a doctor, engineer, or lawyer. But when you start earning your own money—even if it’s just $50 at a wedding or $2 from a party—you realize there are other ways to build wealthy habits. You start to see that you don’t need anyone’s permission to create value or to start a business.

College: The Party Scene vs. Scrappy Hustling

Arriving at college at 17, you might be shocked by how much money your peers spend on partying (10.34-10.49). While others are burning cash on alcohol and nightlife, you’re thinking differently. Instead of joining the party, you wonder: what if you could turn the party into a business?

You take your high school party-planning experience and try to scale it up. You knock on doors of bars and clubs, getting turned down for not having the $10,000 or $20,000 deposits they want (11.06-11.29). But you keep going. Eventually, you find a club willing to let you host events for a share of the cover charge (11.29-11.37). Now, you’re in business for real.

Small Wins, Bigger Opportunities

Those early, scrappy gigs—no matter how small or embarrassing—lay the groundwork for bigger things. The $50 you earned playing the drum, the $4 split from your first party, the countless rejections from club owners: all of it adds up. Each small win reveals a bigger opportunity, and each failure teaches you something you can’t learn from a book.

Through these experiences, you learn to recognize value, build resilience, and spot opportunities where others see obstacles. These are the entrepreneurship lessons that stick with you, long after the money is spent.

Chart: Tracing Small Earnings to Business Growth

$0

$50

(Weddings)

$4

(Teen Party)

College

Events

Business

Growth

Earnings Over Time

Starting small—no matter how humble or awkward—lays real groundwork for understanding value, resilience, and opportunity recognition. The journey isn’t always smooth, but every step, every failure, and every tiny win teaches you more than any classroom ever could.

The Real Money Game: What the Wealthy Actually Do Differently

When you look behind the curtain at how the wealthy approach money, you quickly realize they don’t follow the same script most people are taught. The conventional path—study hard, get good grades, land a prestigious job—might sound like the formula for building wealth, but research shows it’s not what truly sets the wealthy apart (3.37-3.40). Instead, the real money game is about understanding how money works and, more importantly, how to make it work for you.

Understanding the Real Rules of Money

Most people spend years in school, but rarely learn anything about money itself. You might have checked all the boxes: high school, college, maybe even graduate school. Yet, as you probably noticed, there’s little to no focus on financial education, investing, or the difference between an asset and a liability (3.45-4.07). The wealthy, on the other hand, make it a habit to seek out this knowledge on their own. They understand that building wealth isn’t about earning a paycheck—it’s about acquiring assets that generate income, even when you’re not actively working.

Assets vs. Liabilities: The Wealthy Mindset

There’s a clear distinction between working for money and making money work for you. The wealthy focus on acquiring assets—things like businesses, real estate, and stocks—that put money in their pockets. Most people, however, are taught to focus on liabilities, or at best, on earning a higher salary. This difference in mindset is crucial. As the transcript points out, the wealthiest people in the world didn’t get there by climbing the corporate ladder or relying on raises (4.11-4.21). They got there by understanding how to win in the economic system.

- Assets: Generate income and appreciate in value (e.g., rental properties, dividend-paying stocks, businesses).

- Liabilities: Take money out of your pocket (e.g., expensive cars, high-interest debt, lifestyle inflation).

Studies indicate that owning assets is the single biggest differentiator for wealth creation. If you want to build wealth, shifting your focus from liabilities to assets is non-negotiable.

Breaking the Inherited Success Formula

For many, the definition of success is inherited from family or culture. In some households, becoming a doctor or lawyer is seen as the only path to success. This was the case for the author, whose immigrant parents from Punjab, India, insisted that being a doctor was the only way to be successful (4.32-5.55). The pressure was intense—either become a doctor, or be seen as a failure. This mindset is common in many families, where prestige and job security are valued above all else.

But here’s the twist: even after following the prescribed path—finishing law school and becoming a licensed attorney—the realization hit that true success wasn’t about the title or the job. It was about financial autonomy and owning assets. The wealthy don’t chase prestige; they chase ownership. They don’t just climb the corporate ladder—they work to own it.

“Wealthy people are working to own the corporate ladder. Everybody else is working to climb it.”

From Climbing Ladders to Owning Them

Think about the difference between climbing the corporate ladder and owning it. Most people are taught to get a good job, work hard, and hope for promotions. The wealthy, however, are focused on how to grow their assets. They ask, “How can I own the ladder?” rather than, “How can I climb it?” (7.17-7.27)

If you look at the top factors for wealth over the past century, the data is clear: business ownership, real estate, and stocks have built more wealth than any job ever could (6.57-7.08). Yet, these topics are rarely discussed in traditional education. Instead, the focus remains on how to get a good job, not on how to build wealth.

Relentless Pursuit of Financial Education

Another key habit among the wealthy is their commitment to financial education, even after school is over. They read books, attend seminars, and seek out mentors. They know that the rules of the money game aren’t static—they change, and staying informed is essential. This relentless pursuit of knowledge is what keeps them ahead, while others remain stuck in outdated scripts.

Mindset Flip: Playing the Money Game Differently

Ultimately, the biggest shift is in mindset. The wealthy don’t see money as something you simply earn and spend. They see it as a tool—a way to create more opportunities, more freedom, and more impact. They’re not afraid to take calculated risks, because they understand the difference between assets and liabilities, and they know how to make money work for them.

If you want to build wealth, it’s not enough to work hard or chase prestige. You need to rethink what you’ve been taught about money, focus on acquiring assets, and commit to ongoing financial education. That’s the real money game—and it’s how the wealthy play to win.

Assets vs. Liabilities: The Simplest Lesson Most Miss

If you’ve ever picked up a personal finance book or listened to a financial podcast, you’ve probably heard the terms “assets” and “liabilities.” But have you really paused to consider what they mean for your day-to-day life? For many, this distinction is the first real lesson that flips the script on how you view wealth. As mentioned in the transcript (12.50-12.53), the very first thing learned from financial books was the difference between an asset and a liability. Oddly enough, it’s a lesson most people never get in school, and yet it’s foundational for any kind of financial change.

What Is an Asset? What Is a Liability?

Let’s start with the basics. According to the transcript (12.59-13.03), “

An asset is something that puts money in your pocket; a liability is something that takes money out.

” It’s a simple definition, but it’s not the one you’ll find in most accounting textbooks or hear from your bank. Instead, this is a practical, cash-flow-based view—one that’s easy to apply in real life.

- Asset: Anything that regularly puts money into your pocket. Think of rental properties, dividend-paying stocks, or even a side business.

- Liability: Anything that regularly takes money out of your pocket. This includes things like car loans, credit card debt, or even your primary residence if it costs more than it brings in.

It sounds straightforward, but the confusion between asset vs. liability is surprisingly common—even among well-educated adults. You might be surprised at how many people think their house or car is a true asset, without considering the ongoing costs.

Why Most People Get It Wrong

So, why is this distinction so often misunderstood? Part of the problem is that traditional education rarely covers personal finance in a way that’s practical. You might have learned about assets and liabilities in an accounting class, but the definitions were probably more about balance sheets than real life. The transcript (12.55-12.58) points out that these were concepts never even heard of before diving into financial books.

Research shows that misunderstanding the difference between true assets and liabilities can sabotage your finances. If you think of your car or your home as assets simply because you own them, you might overlook the fact that they’re actually draining your resources every month. This confusion can lead to poor financial decisions—like taking on more debt for things that don’t generate income.

Everyday Examples: Are You Sure That’s an Asset?

- Your Car: Most people list their car as an asset. But unless you’re using it to make money (like driving for a rideshare service), it’s more likely a liability. It costs you money in gas, insurance, maintenance, and depreciation.

- Your Primary Residence: This one is controversial. Many believe their home is their biggest asset. But if it doesn’t generate income and requires you to pay a mortgage, taxes, and repairs, it’s technically a liability by the cash-flow definition.

- Student Loans: These are classic liabilities. They take money out of your pocket every month in the form of payments and interest. Even if your education leads to higher income, the loan itself is not an asset.

This way of thinking can be uncomfortable at first. It challenges what you’ve been told about wealth and success. But it’s also liberating, because it gives you a clear framework for making financial decisions.

How to Audit Your Personal Finances for Hidden Liabilities

Ready to see where you stand? A personal finance audit is a powerful tool for uncovering hidden liabilities. Here’s a simple way to get started:

- List everything you own that you consider an asset.

- Next to each item, write down whether it puts money into your pocket or takes money out.

- If it costs you more than it brings in, move it to your liability list.

- Add up the totals for each column.

This exercise can be eye-opening. You might discover that things you thought were true assets are actually liabilities. Or, you might find hidden sources of income you hadn’t considered. As the transcript suggests, self-auditing your finances often leads to surprising realizations about your net worth.

The Surprising Results of a Personal Finance Audit

After you complete your personal finance audit, don’t be surprised if you feel a little shocked. You might be richer—or poorer—than you thought. Many people find that their “assets” are actually costing them money, while overlooked investments or side hustles are quietly building wealth in the background.

This is why understanding the asset vs. liability distinction is so foundational. It’s not just about definitions; it’s about seeing your financial life clearly, so you can make smarter choices moving forward. Studies indicate that acting on this knowledge is one of the most important steps you can take toward true financial change.

So, next time you look at your finances, ask yourself: Is this a true asset, or is it a liability in disguise? The answer might just change the way you think about money forever.

From Scarcity to Strategy: Making Wealth Moves with What You Have

When you think about building wealth, it’s easy to imagine you need a huge sum to get started. Maybe you picture investors with thousands in the bank, or believe that passive income strategies are only for people who already have money. But the truth is, you don’t need millions—or even thousands—to begin. In fact, research shows that disciplined action with small sums, consistently applied, outperforms waiting for windfalls or the “perfect” moment to start. The journey from scarcity to strategy is less about how much you have, and more about what you do with it.

Understanding the Financial Danger Zone

Let’s start by defining what it means to be in the financial danger zone. According to the source material (1.08-1.13), you’re in this zone if you don’t have at least $2,000 saved for emergencies and you’re carrying credit card debt. This is a tough spot, and it’s more common than you might think. It’s also a place where many people feel stuck, believing that without a big windfall, there’s no way out. But that’s not the case. The first step is recognizing where you stand—and then making a plan to move forward, even if your starting point feels small.

The 75/15/10 Plan: A Simple Rule for Budgeting and Investing

One practical approach to budgeting for beginners is the 75/15/10 plan (1.19-1.23). Here’s how it works:

- 75% of your income goes to essentials—housing, food, transportation, and other necessities.

- 15% is set aside for investing and building wealth.

- 10% is allocated to fun, giving, or personal spending.

This plan is simple, actionable, and doesn’t require you to overhaul your entire life overnight. It’s about making small, sustainable changes that add up over time. If you’re in the financial danger zone, your first priority is to build up that emergency fund and pay down credit card debt. But even as you do that, setting aside a small amount—$10, $20, or $100—for investing can make a real difference.

Why Starting Is More Important Than Waiting

One of the biggest myths about money is that you need to wait until you have a lot before you can start making it work for you. The reality? “You can start now with $100, $10, but you have to get started.” (7.43-7.48) This isn’t just motivational talk. Studies indicate that the act of starting—no matter how small—creates momentum. It builds habits, teaches discipline, and helps you learn by doing. Waiting for the perfect opportunity often means never starting at all.

Investing Small Amounts: The Power of Consistency

Let’s imagine a scenario. You have just $10 to invest. It doesn’t seem like much, but if you commit to adding $10 every week, and invest it in a simple, low-fee index fund, you’ll see growth over time. Compound interest works its magic slowly at first, but as your discipline continues, your nest egg grows. This is the foundation of many passive income strategies: start small, stay consistent, and let time do the heavy lifting.

Comparing Outcomes: Small Starts, Big Differences

To illustrate how different starting amounts and habits can impact your financial journey, consider the table below. It compares what happens when you start with different amounts and maintain consistent habits over time:

| Starting Amount | Monthly Contribution | Years Invested | Estimated Value (7% annual return) | Notes |

|---|---|---|---|---|

| $10 | $10 | 5 | $713 | Small, steady discipline |

| $100 | $50 | 5 | $3,627 | Moderate start, consistent |

| $0 | $0 | 5 | $0 | Waiting for “perfect” time |

As you can see, even small, regular investments add up. The key is to start, no matter how modest your means. Excuses about low starting capital are debunked by these practical examples. Commitment and discipline move the needle faster than windfalls or perfect circumstances ever could.

Conclusion: Your Wealth Journey Starts Now

Building wealth isn’t about luck or waiting for the stars to align. It’s about taking action with what you have, right now. If you’re in the financial danger zone, acknowledge it, make a plan, and start moving forward—one small step at a time. Use the 75/15/10 plan to guide your spending and investing. Remember, “You can start now with $100, $10, but you have to get started.” (7.43-7.48) The sooner you begin, the sooner you’ll see progress. And over time, those small, disciplined moves will add up to something much bigger than you might imagine. Your journey from scarcity to strategy is possible—starting today.

TL;DR: Forget what you thought about getting rich—real wealth often comes down to breaking the rules you were handed, learning real money skills the hard way, and playing games no one talks about in school. It’s never too late to start—even with $10.

A big shoutout to The Diary Of A CEO for the enlightening content! You can take a look at it here: https://youtu.be/RSyX_665sEw?si=4XVhfeogxrfIPVmm.