I once believed my future was only a matter of hustle, a delusion shattered when a friend admitted they couldn’t pay their heating bill. This post isn’t a self-help pep talk: it’s about why today’s economy punishes some and rewards others—no matter how clever or hardworking—and why you need to understand the rigged rules before you try to break them. Along the way, I’ll tell you what it felt like to realize my best wasn’t always enough—and what really drives prosperity (or poverty) for people like you and me.

Section 1. The “Just Work Harder” Illusion: Why Personal Grit Fails Against the System

If you’ve ever scrolled through social media or watched a viral business podcast, you’ve probably heard the same tired advice: “Just work harder. Be more entrepreneurial.” It’s a message repeated by ultra-wealthy influencers, but for many people, it’s not just out of touch—it’s downright insulting. As one frustrated voice put it,

“I’m sick of multi-millionaires telling kids who can’t afford to turn the heating on, you just need to be more entrepreneurial. It’s sick.”

(0:02-0:07)

Let’s be honest: the cost of living crisis is real, and it’s hitting the middle class and working poor harder than ever. You might know someone—maybe it’s even you—who works full-time, juggles family responsibilities, and still can’t afford basics like heating. I have a friend who fits this description exactly. Despite doing everything “right,” from holding down a job to budgeting carefully, their kids still go to bed cold. It’s not laziness. It’s not lack of ambition. It’s the system.

The myth of meritocracy is everywhere in pop culture. Movies and TV shows love to tell us that if you just hustle hard enough, you’ll make it. But research shows that rising costs, stagnant wages, and generational poverty create barriers that grit alone can’t break. The reality? Not everyone starts at the same place. And when the rules of the game keep changing—like when UK energy prices become the highest in the Western world (9:22-9:24), or when saving for a home deposit jumps from three years to twenty (9:28-9:31)—hard work loses its power as a ladder out of poverty.

| Cost Factor | Historical Data | Current Trend |

|---|---|---|

| UK Energy Prices | Lower than Western average | Highest in Western world |

| Time to Save for Home Deposit | 3 years | 20 years (theoretical) |

So why does this entrepreneurship myth persist? Partly, it’s comforting. It lets those at the top believe their success is earned, not inherited. It also gives hope—false hope, sometimes—to those struggling below. But good advice is only useful when it matches reality. If you’re facing systemic obstacles—sky-high rent, energy poverty, or generational poverty—no amount of “hustle” will magically fix things overnight.

I’ve been there myself. I studied hard, worked multiple jobs, and still found myself stuck. It’s exhausting to keep pushing when the finish line keeps moving. And the worst part? When you start to believe it’s your fault. The psychological toll of internalizing failure can be crushing. Many young people, especially those from low-income backgrounds, end up blaming themselves for things beyond their control. That’s not just unfair—it’s harmful.

The truth is, the cost of living crisis and entrenched inequality make it harder than ever for hard work to pay off. Studies indicate that without addressing these systemic barriers, entrepreneurship myths will continue to let down those who need real solutions the most.

Section 2. The Real Culprits: How Governments and Policy Choices Shape Wealth Gaps

Let’s cut through the noise: working harder isn’t the main factor deciding whether you move up or down the economic ladder. Instead, it’s the policies and choices made by governments—especially when it comes to taxes, regulations, and education systems—that really shape the wealth gap you see today. If you’ve ever wondered why the middle class feels squeezed, you’re not alone. The answer often lies in the details of government intervention in the economy and how it affects economic freedom.

How Economic Freedom Index Tells the Real Story

There’s a powerful tool called the economic freedom index (see transcript 9.54-9.56). This index measures how easy it is for you to start a business, access free markets, and control your own financial destiny. In simple terms, it asks: how much does your government let you make your own economic choices? Research shows that countries with high economic freedom tend to have much lower poverty rates, while those with more restrictions see poverty soar. As one expert puts it:

“Countries that have high degrees of economic freedom have very low poverty; those with low economic freedoms have high poverty.”

The Lingering Impact of the 2008 Financial Crisis

Let’s rewind to 2008. The global financial crisis hit, and governments—especially in the UK—responded by ramping up debt, raising taxes, and introducing new regulations (see transcript 10.43-10.57). The intention was to stabilize the economy, but the side effect was a steady erosion of economic freedom. When the pandemic struck, this trend only accelerated: more government spending, higher taxes, and even more rules. The result? Less economic freedom for everyone.

Case Study: UK vs. India—A Tale of Two Trajectories

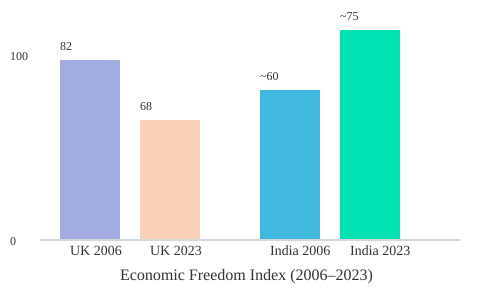

Consider the UK. In 2006, the UK’s economic freedom index stood at a robust 82 out of 100. Fast forward to 2023, and it’s dropped to 68 (see transcript 11.12-11.18). That’s a significant loss of freedom—and, predictably, research indicates that such declines reliably lead to higher poverty and less upward mobility.

Now, look at India. Over the same period, India’s economic freedom index improved rapidly. The result? Poverty rates plummeted from around 70% to under 10%. This isn’t just a coincidence. As India liberalized its economy and reduced barriers, more people were able to lift themselves out of poverty. That’s a stark poverty rates comparison that speaks volumes about the power of policy.

What Happens When Government Intervention Spikes?

When governments increase debt, taxes, and regulations, economic freedom shrinks. This isn’t just theory—it’s what the numbers show. Big government and rigid education systems don’t just slow growth; they widen inequality, making it harder for the middle class to get ahead. Blaming individuals for not working hard enough misses the point. It’s the system, shaped by policy, that sets the rules of the game.

Visualizing the Shift: Economic Freedom Index (2006–2023)

So, if you could design an economy from scratch, would you choose more freedom or more intervention? The data makes a compelling case for the former. Next time someone blames individuals for inequality, remember: it’s often the system—and the policies behind it—that matter most.

Section 3. The Interest Rates Game: How Expert Predictions Failed a Generation

If you want to understand the roots of today’s wealth inequality debate and the twists in UK economic trends, you need to look back at the wild ride of interest rates history during the late 2000s. Imagine yourself as a 21-year-old, fresh out of university, stepping onto the trading floor at Citibank in London in June 2008 (3.03–3.13). That was me—just before the world changed.

I joined as a short-term interest rates trader, a job that, until then, had been considered a bit dull. But when the credit crisis hit, everything flipped. Suddenly, the market for short-term loans became the epicenter of global finance. Nobody could borrow money, and the stakes were sky-high (3.17–3.29). My desk, once overlooked, was now at the heart of the storm. Within months, I watched as colleagues—many just a few years older—made fortunes by betting on continued collapse. It was surreal, exhilarating, and, at times, terrifying.

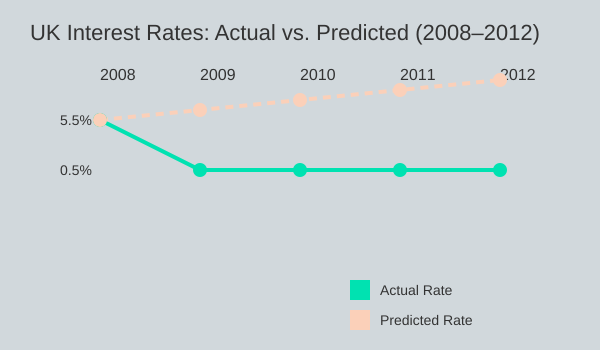

But what really stuck with me wasn’t just the chaos of the crisis itself. It was what happened afterward. You see, in 2008, interest rates went from a steady 5.5% to nearly zero overnight (4.00–4.13). The logic was simple: when the economy is weak, rates drop; when it’s strong, they rise. So, the big question became: when would rates go back up? When would the recovery arrive?

Here’s where the story gets interesting—and where the “delusion of expertise” comes in. Despite the best minds in finance and economics, despite all the data and the models, the predictions kept missing the mark. “Everybody is wrong year after year after year—and this was amazing to me.” That’s not just a throwaway line; it was the reality (quote). Every year, experts forecasted a return to higher rates. Every year, it didn’t happen. The consensus was always that recovery was just around the corner. Yet, rates stayed pinned at 0–0.5% from 2008 onward, defying every projection (4.13–4.47).

Research shows this persistent optimism wasn’t just a harmless mistake. It created real opportunities—and risks. Traders who saw through the consensus made millions by betting that rates would stay low. Others, trusting the experts, lost fortunes. The cycle repeated: misplaced confidence, unexpected outcomes. It was a masterclass in how interest rates history can shape, and sometimes shatter, financial destinies.

This period is a powerful reminder that even the most educated experts—many with degrees from places like the London School of Economics—can get it wrong, especially when the world changes faster than their models can keep up. The impact rippled far beyond the trading floor, influencing everything from mortgage rates to the broader wealth inequality debate that still shapes UK economic trends today.

Section 4. A Tale of Two Rags-to-Riches Stories—And Their Limits

When you hear about income mobility in the UK or stories of breaking out of generational poverty, it’s tempting to focus on the rare, dazzling exceptions. Take Gary Stevenson and Daniel Priestley—two individuals whose journeys seem to defy the odds. But if you look closer, their stories reveal more about the limits of entrepreneurship myths than about the real drivers of inequality.

Gary: From Ilford’s Streets to Citibank’s Top Trader

Gary Stevenson’s story begins in Ilford, East London, a place known more for its modest terrace houses and railway lines than for producing millionaire bankers (2.32-2.36). Growing up in a working-class family, Gary spent his childhood playing football in the street, not unlike many kids with few resources and fewer connections (2.40-2.42). But Gary had a knack for maths, which eventually earned him a spot at the London School of Economics—a university that acts as a gateway to elite finance jobs (2.46-2.54). By 21, he was trading short-term interest rates at Citibank, landing right in the middle of the 2008 financial crisis (3.03-3.17). Within a few years, he’d made $35 million for the bank by age 24.

It sounds like a classic rags-to-riches tale. But as Gary himself has pointed out, luck and timing played enormous roles. If he’d been born ten years earlier or in a different postcode, would the outcome have been the same? The answer is probably not.

Daniel: From Fast Food to Serial Entrepreneur

Daniel Priestley’s path was different, but the odds were just as steep. Raised in rural Australia, Daniel grew up in a town with 24% unemployment (7.27-7.32). The available jobs were mostly in trades, pest control, or hospitality. At 14, he started working at McDonald’s, then moved on to pizza delivery and bar work (7.44-7.48). Eventually, Daniel discovered books on entrepreneurship and realized some people managed to break out and build wealth (7.51-7.55). Today, he’s founded or acquired seven companies, including one of the UK’s fastest-growing software firms.

Again, it’s easy to see Daniel’s story as proof that anyone can make it. But research shows these stories are exceptions, not the rule. Most people grinding away at fast food jobs don’t become serial entrepreneurs. The system makes such outcomes rare, not typical.

The Temptation—and the Trap—of Outlier Stories

There’s a powerful urge to hold up people like Gary and Daniel as evidence that hard work and hustle are all you need to escape generational poverty. But as Daniel himself notes, “If I had come across your content at 19 or 20, I would have been screwed. My friends can’t feed their kids.” Survivorship bias is real. For every outlier, there are countless others whose stories go untold.

So, while these tales inspire, they also risk reinforcing entrepreneurship myths and masking the structural barriers that keep most people from moving up. Income mobility in the UK, and elsewhere, is shaped as much by luck, timing, and geography as by grit or talent. The real drivers of inequality are often invisible in the glow of these rare success stories.

Section 5. The Collapsing Middle: Is Western Society Becoming South Africa or India?

If you’ve been feeling the squeeze of the cost of living crisis, you’re not alone. Research shows that sharp increases in basic living costs are putting enormous pressure on the middle class, inching Western societies toward the kind of entrenched inequality often seen in places like South Africa or India (6.58-7.11). It’s a direct warning: if current trends continue, the UK and US could face a future marked by generational poverty and stark poverty rates comparison with less affluent nations.

Let’s break down what this means for you. Imagine a Britain where daily energy blackouts are the norm, Mumbai-style slums emerge on city outskirts, and only the ultra-wealthy can afford to live in secure, gated communities. This scenario might sound extreme, but it’s not as far-fetched as it once seemed. Recent spikes in food and fuel costs, combined with stagnant or even falling real wages, are making it harder for ordinary families to get by (9.22-9.35).

Middle-Class Affordability: Then vs. Now

Consider the basics: housing, food, and energy. These aren’t luxuries—they’re essentials. Yet, the numbers tell a stark story:

| Category | Then | Now |

|---|---|---|

| UK House Deposit | 3 years’ savings | 20 years’ savings |

| Energy Prices | Affordable | “Gone through the roof” |

| Food Prices | Manageable | “Gone through the roof” |

| Inequality Risk | Low | Growing, entrenched |

The data is clear: what used to be achievable for the average worker—like saving for a house deposit in just a few years—now feels out of reach for most (9.26-9.33). Energy and food prices have soared, creating new forms of energy poverty and food insecurity. These aren’t just statistics; they’re daily realities for millions.

Is Your Job, House, or Community Next?

There’s a sense of “future shock” in the air. You might wonder if your job, your home, or even your local community could be the next to fall victim to these pressures. The idea that broad, persistent poverty “can’t happen here” is being challenged by real-world events and hard numbers (7.06-7.11). Past affluence doesn’t guarantee a future free from deep poverty.

“If you allow the rich to get richer, they squeeze the middle class and the poor class out of things like housing.”

This isn’t just a theoretical risk. As wealth becomes more concentrated, the middle class gets squeezed out of essentials like housing, echoing patterns seen in countries with high poverty rates. The comparison to South Africa, Nigeria, and India is no longer just a warning—it’s a real possibility if current trends continue.

Section 6. Blame Games and Cultural Memories: Who Gets the Finger When Things Fall Apart?

When you look at the wealth inequality debate, it’s easy to see that who we blame for economic problems depends a lot on where we live—and the stories our cultures have told us for generations. If you’re in the UK, the finger often points at the rich: landlords, aristocrats, and what’s sometimes called the “landed gentry.” This isn’t just a modern trend. As the transcript notes (11.54-12.06),

“In the UK, we have a cultural memory that the people to blame are the rich.”

The roots of this blame go deep, shaped by centuries of class divisions, land ownership, and a long history of economic power being concentrated among a few.

Now, shift your gaze to the US. The story changes. Here, suspicion is aimed less at the wealthy and more at government and political elites. The transcript (12.09-12.14) highlights this difference:

“In the US, they want limited government.”

This anti-government sentiment isn’t new, but it’s especially visible in popular culture. Take the 2023 chart-topping song “Rich Men North of Richmond”—a cultural artifact that captured the mood of many Americans frustrated with political elites and government intervention in the economy.

So, why do these blame patterns matter in the context of UK economic trends and the broader wealth inequality debate? Research shows that blame culture is highly context-dependent. In the UK, blaming the rich fits a narrative of entrenched class systems and historic economic divides. In the US, the government is often seen as the meddler, the one to watch with suspicion. These cultural memories shape not only who gets blamed, but also how solutions are proposed—or avoided entirely.

It’s worth asking: does blame ever really help? Studies indicate that while blame can be a coping mechanism during times of societal stress, it rarely leads to real change unless it’s paired with a deeper, systemic analysis. Blame can distract us from the real drivers of inequality, sowing division and making it harder to find common ground. Instead of tackling the root causes—like stagnant wages, housing shortages, or the complexities of government intervention in the economy—we get stuck pointing fingers.

Imagine this: your power bills double overnight. Who do you blame first? Is it the energy company, the government, or some faceless billionaire? The answer likely depends on your cultural background and the stories you’ve absorbed. This “blame logic” isn’t just a quirk; it’s a historical habit that never quite fades. And sometimes, it feels like we’re hardwired to look for simple villains, even when the reality is far more complicated.

Ultimately, the way we assign blame—whether it’s the rich, the government, or someone else—reflects deeper cultural patterns. These patterns influence not just our opinions, but also the policies we support and the solutions we’re willing to consider. Understanding this is crucial if we want to move beyond blame and toward real progress in the wealth inequality debate.

Section 7. Are There Any Exit Ramps? Smarter Policies and The Limits of Optimism

When you look at the big picture, it’s easy to wonder: can smarter economic policy really make a difference? The answer, as research shows, is yes—but it’s complicated. The stories of India and the UK offer a striking poverty rates comparison that reveals just how much government intervention in the economy, and the level of economic freedom, can shape outcomes for the middle class and the poor.

India’s Climb Out of Poverty: A Case Study in Economic Freedom

Let’s start with India. Over the past few decades, India has followed a path of economic liberalization, opening up markets and reducing barriers to business (10.28-10.31). The results? According to recent data, poverty has dropped dramatically—from around 70% in previous decades to less than 10% in 2023. As one expert put it,

‘When countries go on a path towards economic freedom, poverty just drops.’

This isn’t just a statistic; it’s a real transformation in the lives of millions. The economic freedom index for India has steadily improved, and with it, the prospects for its citizens.

The UK’s Slide Backwards: The Impact of Government Intervention

Contrast this with the UK. In the early 2000s, the UK enjoyed high economic freedom, with an index score of 82 out of 100 in 2006 (10.12-11.18). Poverty rates were falling, and the middle class was relatively stable. But after the 2008 global financial crisis, everything changed. The government stepped in, ramping up debt, increasing taxes, and adding new regulations (10.45-11.01). The intention was to stabilize the economy, but the result was a steady decline in economic freedom—to just 68 out of 100 by 2023. Predictably, as economic freedom dropped, inequality and financial stress for the middle class began to rise (11.18-11.28).

Trade-Offs: Economic Freedom vs. Social Protections

This brings up a tough question: do we have to choose between economic freedom and social protections? It’s not always a simple trade-off. Sometimes, well-meaning interventions—like higher taxes or more regulation—can backfire, driving wealth and talent offshore and making it harder for the economy to grow. Other times, targeted government intervention in the economy can help those who need it most. The key is context. Studies indicate that the success or failure of these policies often depends on how they impact economic freedoms and whether they encourage innovation and opportunity.

When Good Intentions Go Wrong

It’s tempting to think that more government action is always better, especially in times of crisis. But as the UK’s experience shows, increasing taxes and regulations can sometimes do more harm than good, especially if they stifle growth or drive away investment. The lesson? There’s no one-size-fits-all solution. Policymakers need to weigh the trade-offs carefully and be willing to experiment with bold, new approaches.

A (Hopeful?) Note: Imagining Bold, Experimental Policy

So, what would a bold, experimental policy look like today? Maybe it’s a mix of targeted support for those in need, combined with policies that keep the economy open and dynamic. Perhaps it’s about finding new ways to balance economic freedom with smart, effective government intervention. The evidence is clear: some interventions work, others don’t. The challenge is figuring out which is which—and having the courage to try something new when the old ways aren’t working.

Section 8. Conclusion: It’s Not Just You—But You’re Part of the Answer

If you’ve ever felt frustrated hearing advice from people who seem out of touch—like multi-millionaires telling struggling families to just “work harder” (0.00-0.05)—you’re not alone. It’s easy to wonder if the wealth inequality debate is missing the point, especially when the cost of living crisis keeps hitting harder, no matter how much effort you put in. The truth is, your doubts and frustrations are valid. Success isn’t just about personal grit or working longer hours. There are bigger forces at play.

Let’s be clear: the story that anyone can “make it” if they just try hard enough is only part of the picture. Myths like these ignore how policy, culture, and history shape who gets ahead and who gets left behind. Research shows that structural conditions—like tax policy, access to education, and even cultural attitudes—have a huge impact on wealth distribution. These aren’t things you can change overnight, and they aren’t things you can fix by yourself. But that doesn’t mean you’re powerless.

When you look at the roots of inequality, it’s not just about individual choices. It’s about the systems and policies that set the rules of the game. For example, policy reform can slowly shift the landscape, making it fairer for everyone. But as studies indicate, changing these structures is slow, often frustrating work. Still, it’s essential—and possible. Every time you engage in the wealth inequality debate, push for smarter policy, or even educate yourself and others, you’re chipping away at fatalism. You’re refusing to accept that things have to stay this way.

It’s also worth asking yourself: if you could speak to your future self, what would you want to know about inequality? Would you ask if the cost of living crisis ever eased? Or if policy reform finally made a difference? Maybe you’d want to know what role you played, or if collective action really worked. These questions matter, because they remind us that the story isn’t finished yet—and you’re part of what happens next.

So, what can you do? First, look beyond blame. It’s not just about individual failure or success. It’s about understanding the structures that shape our lives. Culture, policy, and individual action all play a part. The first step is awareness: recognizing that the system is complex, but not unchangeable. When you join the conversation, support policy reform, or simply refuse to accept easy answers, you’re already making a difference.

The wealth inequality debate isn’t just about numbers or headlines. It’s about real people, real struggles, and the possibility of real change. The cost of living crisis may feel overwhelming, but collective awareness and smarter choices can move the needle. It’s not hopeless—far from it. Understanding the system is the first step toward changing it.

FAQ: Rapid-Fire Answers to Readers’ Big Questions

The wealth inequality debate can feel overwhelming, especially when you’re bombarded with headlines about policy reform, the economic freedom index, and the shrinking middle class. Here, we tackle the most pressing questions that emerged from the discussion between Gary Stevenson and Daniel Priestley—cutting through myths and offering real-world advice.

Can I really beat the system with hustle?

Both experts agree: it’s harder than ever. Gary’s story—rising from poverty to Citibank trading floors—was possible in a different era. Today, the odds are stacked against most people, especially with asset prices soaring and wages stagnating. Daniel insists that digital skills and entrepreneurship open new doors, but even he admits that only a small percentage will “make it.” The reality? Hard work matters, but structural barriers are bigger than before. Don’t blame yourself if the old promises of social mobility feel out of reach.

Is economic freedom always good, or does it have downsides?

Daniel champions economic freedom, pointing to the economic freedom index as a predictor of prosperity. Countries like Singapore and Switzerland, he argues, thrive because they attract wealth creators. But Gary warns that unchecked freedom can mean the rich get richer while the rest fall behind. The debate shows that while economic freedom can boost growth, it needs guardrails—otherwise, inequality spirals and social trust erodes.

Why does blaming the rich or government rarely solve anything?

It’s tempting to point fingers, but both experts caution against simple scapegoats. Gary argues that the system is rigged in favor of asset owners, but also notes that without policy reform, nothing changes. Daniel points out that driving out the wealthy can shrink the tax base, hurting public services. The takeaway: real solutions require collective action, not just blame.

What’s the fastest way for a country to reduce poverty?

There’s no silver bullet. Daniel highlights pro-entrepreneurship policies and low taxes, while Gary stresses the need for fair asset distribution and targeted taxation of extreme wealth. History suggests that broad-based prosperity comes from a mix of opportunity and redistribution—think post-WWII reforms, not just deregulation or austerity.

How did the global financial crisis change the rulebook?

The 2008 crisis—and the pandemic after it—shifted the landscape. Governments pumped trillions into economies, but much of that wealth flowed to asset owners and the already-rich. The result? Soaring inequality, stagnant wages, and a middle class squeezed by debt and rising costs. The crisis exposed deep flaws in the system, making the case for smarter, fairer policy reform.

Are there any modern policies worth championing as universal solutions?

Both experts agree: education must change. Teaching digital skills and entrepreneurship is vital, but so is making sure opportunity isn’t reserved for a lucky few. Wealth taxes, fairer housing policies, and smarter regulation all have a role—though implementation is tricky in a globalized world.

What country’s story gives the most hope for breaking the inequality cycle?

Singapore, Ireland, and Switzerland are often cited for their economic freedom and prosperity. But as Gary notes, even these places have hidden struggles—like low-wage workers living in cramped conditions. No country has cracked the code, but those that balance opportunity and fairness come closest.

How do I start learning more (without losing hope)?

Stay curious. Follow credible voices—Gary’s YouTube channel, Daniel’s books, and data-driven sources on the economic freedom index. Get involved in policy debates, and don’t underestimate the power of collective action. The system is complex, but understanding it is the first step toward meaningful change.

In the end, the wealth inequality debate isn’t just about numbers—it’s about your future. Policy reform, economic freedom, and a fair shot at prosperity are all on the table. The challenge is real, but so is your ability to shape what comes next.

TL;DR: Hard work and entrepreneurship alone can’t overcome the widening structural divides in modern economies. Real solutions lie in understanding—and challenging—the systems that decide who wins and who loses.

A big shoutout to The Diary Of A CEO for the valuable insights! Be sure to check it out here: https://youtu.be/4yohVh4qcas?si=7zy2At3C8karDBrQ.